jquants-ml is a python library for machine learning with japanese stock trade using J-Quants on Python 3.8 and above.

Project description

jquants-ml

jquants-ml is a python library for machine learning with japanese stock trade using J-Quants on Python 3.8 and above.

Installation

$ pip install jquants-ml

Usage

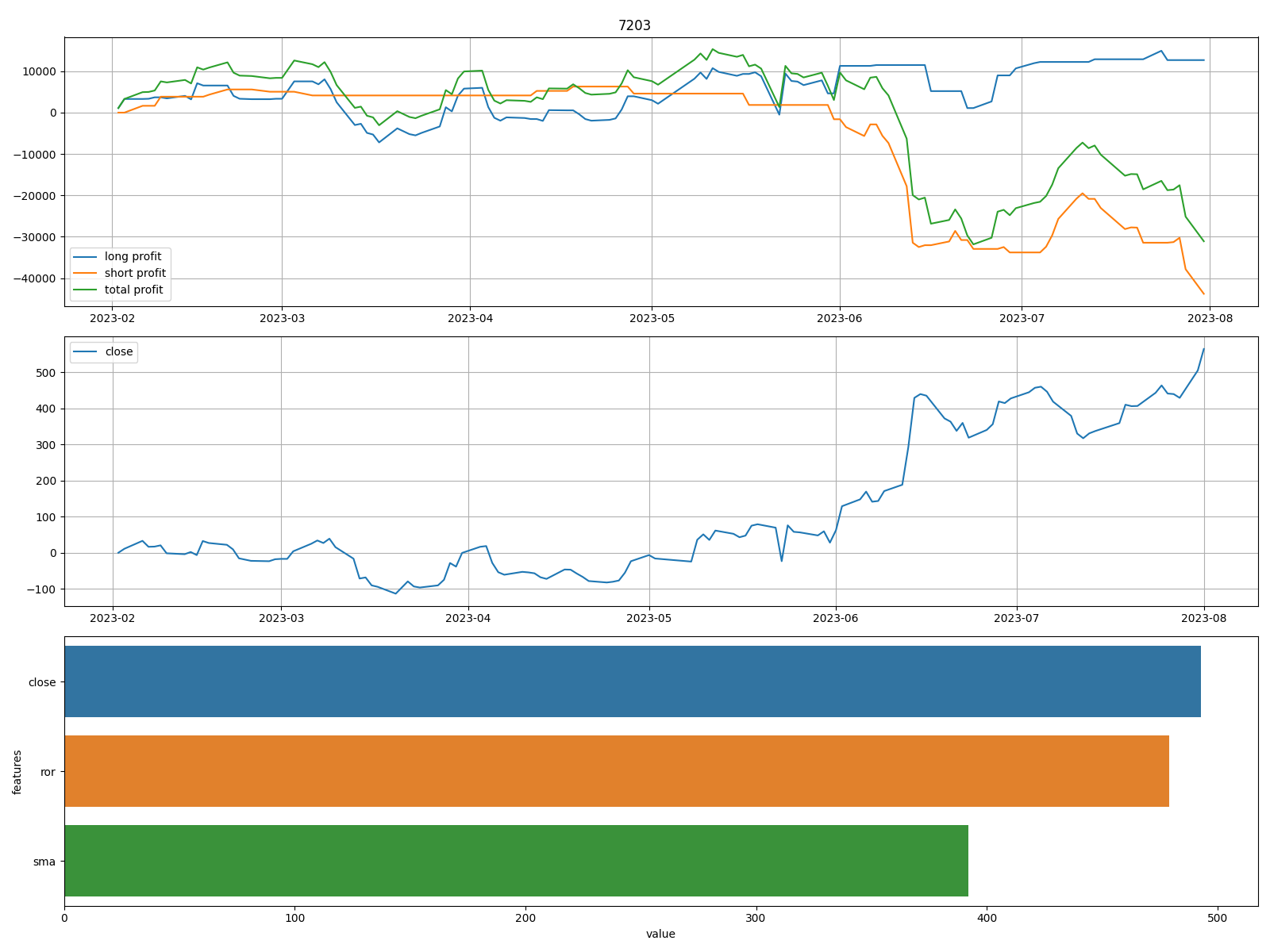

basic backtest

from jquants_ml import Ml

import pprint

class MyMl(Ml):

def features(self):

self.X["close"] = self.df.Close

self.X["ror"] = self.df.Close.pct_change(1)

self.X["sma"] = self.sma(period=5)

ml = MyMl(

mail_address="<your J-Quants mail address>",

password="<your J-Quants password>",

ticker="7203", # TOYOTA

size=100, # 100 shares

)

pprint.pprint(ml.backtest())

{'long': {'maximum drawdown': '17900.000',

'profit': '28450.000',

'profit factor': '1.160',

'riskreward ratio': '1.137',

'sharpe ratio': '0.056',

'trades': '196.000',

'win rate': '0.505'},

'short': {'maximum drawdown': '73050.000',

'profit': '-37700.000',

'profit factor': '0.769',

'riskreward ratio': '0.828',

'sharpe ratio': '0.088',

'trades': '108.000',

'win rate': '0.481'},

'total': {'maximum drawdown': '60950.000',

'profit': '-9250.000',

'profit factor': '0.973',

'riskreward ratio': '0.986',

'sharpe ratio': '0.069',

'trades': '304.000',

'win rate': '0.497'}}

basic predict

from jquants_ml import Ml

import pprint

class MyMl(Ml):

def features(self):

self.X["close"] = self.df.Close

self.X["ror"] = self.df.Close.pct_change(1)

self.X["sma"] = self.sma(period=5)

ml = MyMl(

mail_address="<your J-Quants mail address>",

password="<your J-Quants password>",

ticker="7203", # TOYOTA

size=100, # 100 shares

)

pprint.pprint(ml.predict())

{'Date': '2023-09-25', 'Price': 2761.5, 'Sign': 'short'}

advanced

from jquants_ml import Ml

class MyMl(Ml):

# Awesome Oscillator

def ao(self, *, fast_period: int = 5, slow_period: int = 34):

return ((self.df.H + self.df.L) / 2).rolling(fast_period).mean() - (

(self.df.H + self.df.L) / 2

).rolling(slow_period).mean()

def features(self):

self.X["ao"] = self.ao(fast_period=5, slow_period=34)

self.X["close"] = self.df.Close

self.X["ror"] = self.df.Close.pct_change(1)

self.X["sma"] = self.sma(period=5)

self.X["ema"] = self.ema(period=5)

self.X["upper"], self.X["mid"], self.X["lower"] = self.bbands(

period=20, band=2

)

self.X["macd"], self.X["signal"] = self.macd(

fast_period=12, slow_period=26, signal_period=9

)

self.X["k"], self.X["d"] = self.stoch(k_period=5, d_period=3)

self.X["rsi"] = self.rsi(period=14)

self.X["atr"] = self.atr(period=14)

self.X["mom"] = self.mom(period=10)

ml = MyMl(

mail_address="<your J-Quants mail address>",

password="<your J-Quants password>",

ticker="7203", # TOYOTA

size=100, # 100 shares

outputs_dir_path="outputs",

model_dir_path="model",

data_dir_path="data",

)

pprint.pprint(ml.backtest())

pprint.pprint(ml.predict())

Supported indicators

- Simple Moving Average 'sma'

- Exponential Moving Average 'ema'

- Moving Average Convergence Divergence 'macd'

- Relative Strenght Index 'rsi'

- Bollinger Bands 'bbands'

- Market Momentum 'mom'

- Stochastic Oscillator 'stoch'

- Average True Range 'atr'

Getting started

For help getting started with J-Quants, view our online documentation.

Project details

Download files

Download the file for your platform. If you're not sure which to choose, learn more about installing packages.

Source Distribution

jquants-ml-0.1.2.tar.gz

(6.9 kB

view hashes)

Built Distribution

Close

Hashes for jquants_ml-0.1.2-py3-none-any.whl

| Algorithm | Hash digest | |

|---|---|---|

| SHA256 | 9724416ea08a0c254e0df1cc2093dc1086ef277b60960a8135b7d7cc2a14f589 |

|

| MD5 | c9807f3ae8ac1b0c502956a203670c79 |

|

| BLAKE2b-256 | 7c22e8ddfb52c1f148b69a3411bece2ee4a8cda2bf0b3f5e451d23776dba939c |