Inversione contabile

Project description

Italiano

Modulo per gestire l’inversione contabile (reverse charge) nelle fatture fornitore.

Il modulo permette di automatizzare le registrazioni contabili derivate dalle fatture fornitori intra UE ed extra UE mediante l’inversione contabile IVA. Inoltre è automatizzata la procedura di annullamento e riapertura della fattura fornitore.

È inoltre possibile utilizzare la modalità “con autofattura fornitore aggiuntiva”. Questa modalità è usata tipicamente per i fornitori extra UE per mostrare, nel registro IVA acquisti, una fattura intestata alla propria azienda (autofattura passiva). L’autofattura passiva verrà poi totalmente riconciliata con l’autofattura attiva, anch’essa intestata alla propria azienda.

English

Module to handle reverse charge IVA in vendor bills.

The module allows you to automate the accounting entries derived from invoices of intra-EU and extra-EU suppliers through the VAT reverse charge. Furthermore, the vendor bill cancellation and reopening procedure is automated.

It is also possible to use the “additional vendor self billing” mode. This mode is typically used for non-EU suppliers to show, in the purchases VAT journal, a vendor bill addressed to your own company (self-bill). The self-bill will then be completely reconciled with the self-invoice, which is also addressed to your own company.

Table of contents

Configuration

Italiano

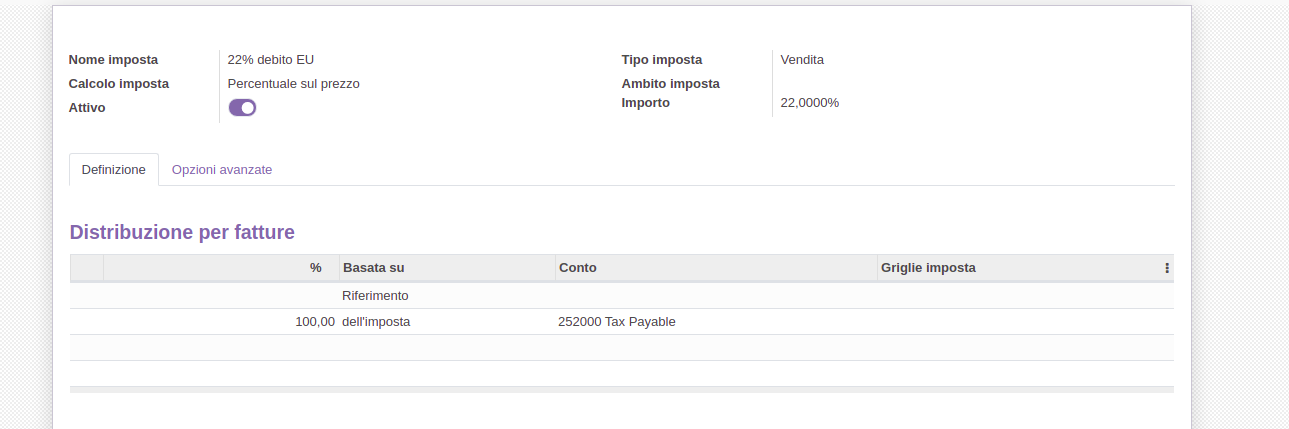

Creare l’imposta 22% intra UE - Vendite:

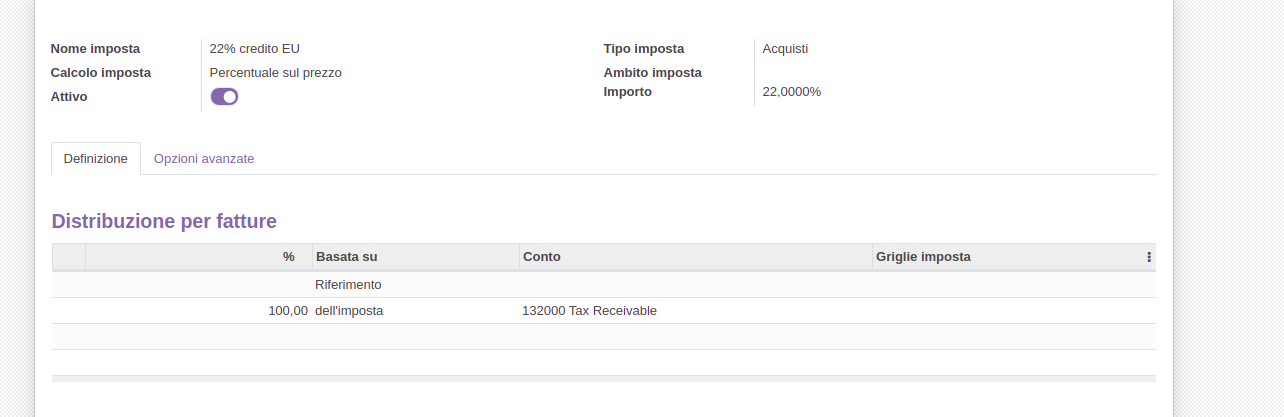

Creare l’imposta 22% intra UE - Acquisti:

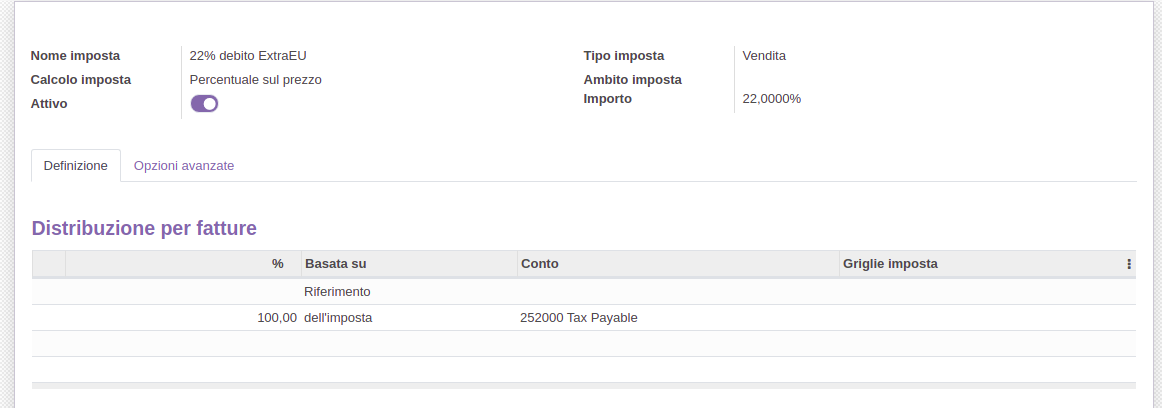

Creare l’imposta 22% extra UE - Vendite:

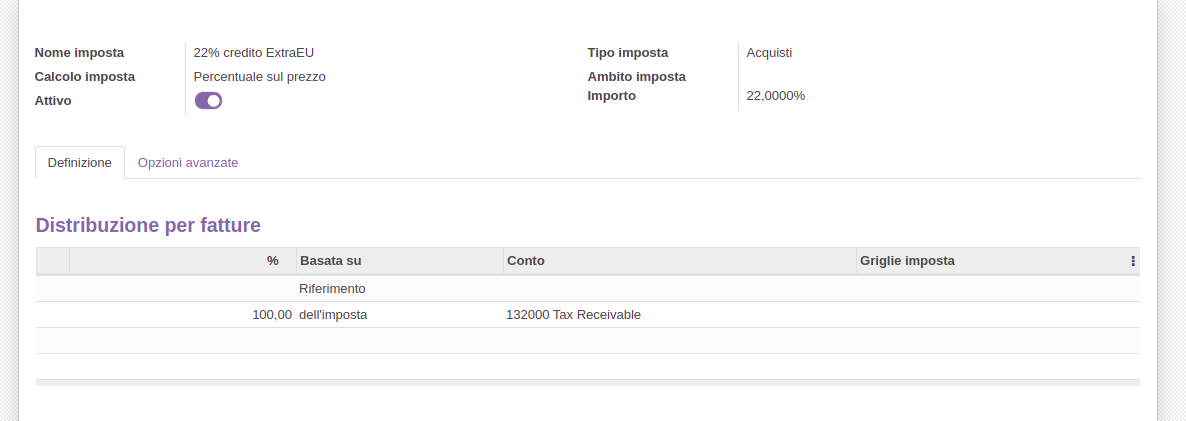

Creare l’imposta 22% extra UE - Acquisti:

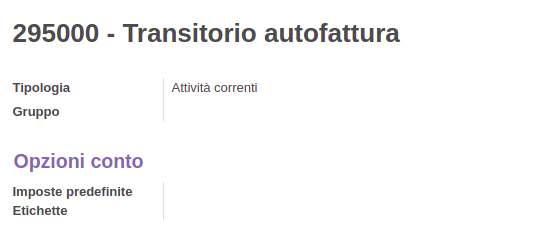

Creare il conto ‘Transitorio autofatturazione’:

Creare il registro ‘Riconciliazione RC’ di tipo Varie.

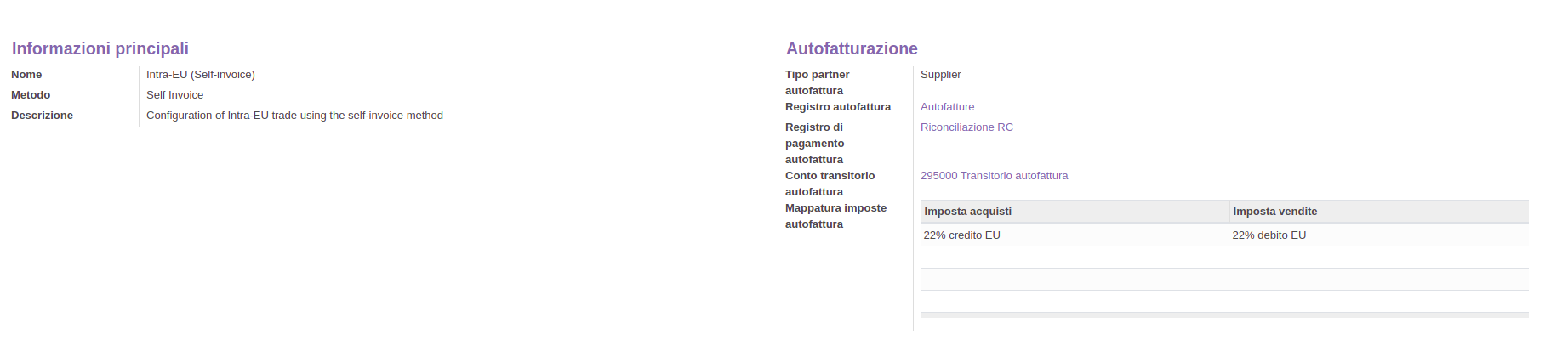

Modificare il tipo inversione contabile Intra-UE (autofattura):

Il registro autofattura deve essere di tipo ‘Vendita’.

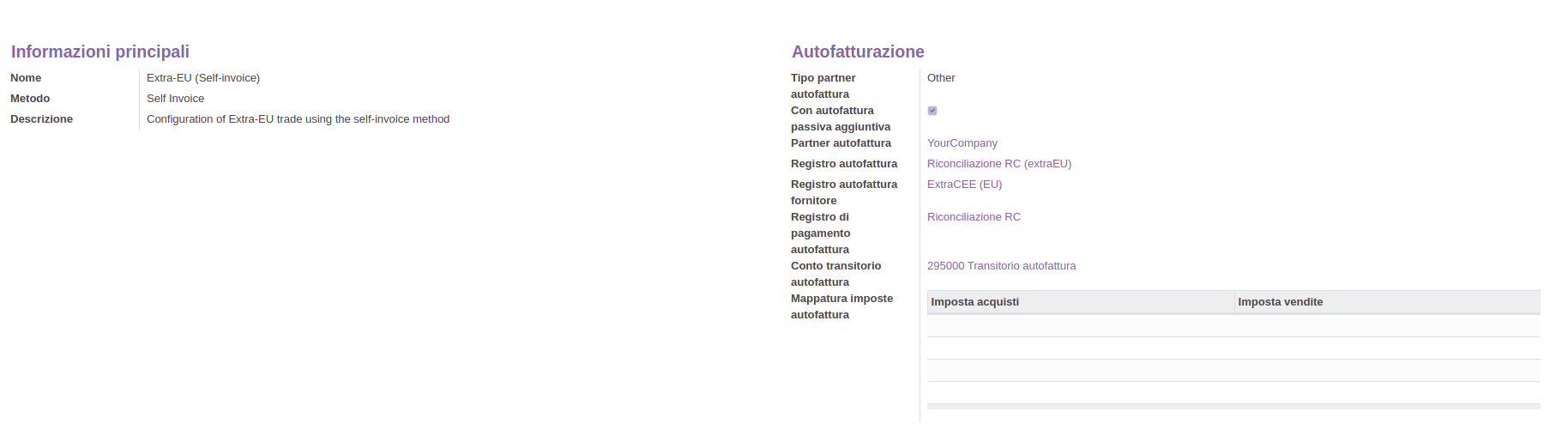

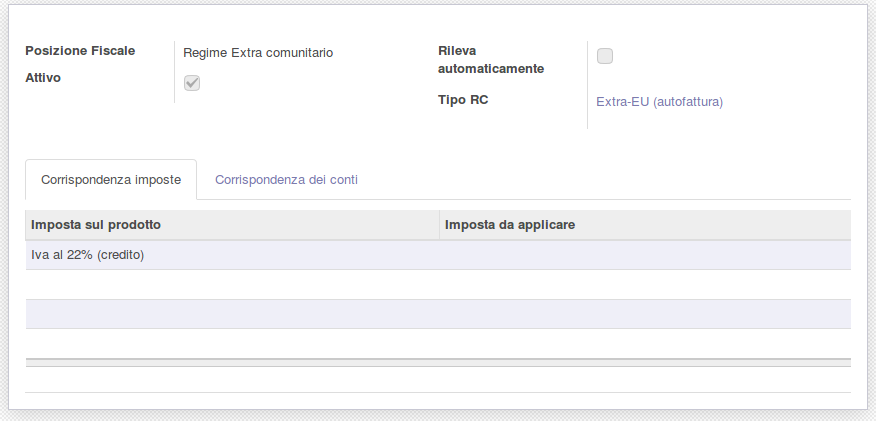

Modificare il tipo inversione contabile Extra-UE (autofattura):

Il ‘Registro autofattura passiva’ deve essere di tipo ‘Acquisto’.

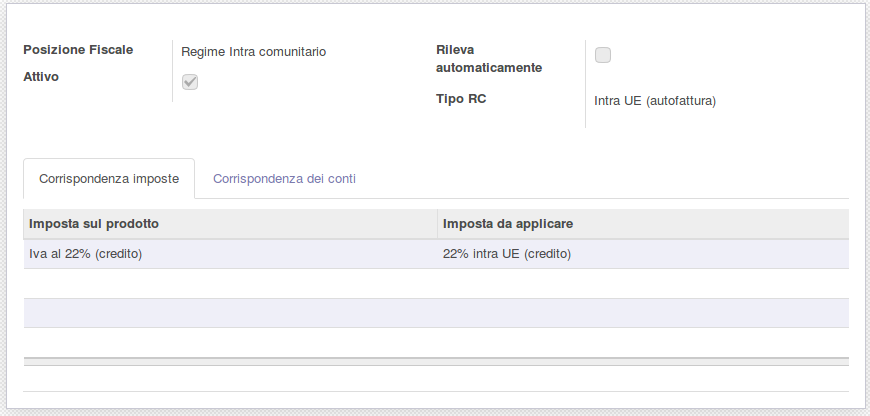

Nella posizione fiscale, impostare il tipo inversione contabile:

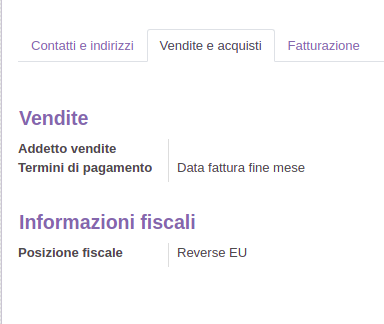

La posizione fiscale deve essere salvata sui contatti dei fornitori nel campo ‘Posizione fiscale’

English

Create the tax 22% intra EU - Sale:

Create the tax 22% intra EU - Purchase:

Create the tax 22% extra EU - Sale:

Create the tax 22% extra EU - Purchase:

Create the account ‘Self Invoice Transitory’ as follows:

Create the ‘RC Reconciliation’ Journal of type Miscellaneous.

Edit the reverse charge type Intra-EU (self-invoice):

The Self Invoice journal has to be of type ‘Sale’.

Edit the reverse charge type Extra-EU (self-invoice) :

The ‘Supplier Self Invoice Journal’ has to be of type ‘Purchase’.

In the fiscal position, set the reverse charge type:

Fiscal position has to be saved on suppliers’ contact inside ‘Fiscal position’ field

Known issues / Roadmap

Only the self-invoice method is managed, VAT integration method is not managed yet.

In test case test_intra_EU_exempt, the payment line to be reconciled is reconciled without having any reconciliation; it should be reconciled with the invoice.

Bug Tracker

Bugs are tracked on GitHub Issues. In case of trouble, please check there if your issue has already been reported. If you spotted it first, help us to smash it by providing a detailed and welcomed feedback.

Do not contact contributors directly about support or help with technical issues.

Credits

Contributors

Davide Corio

Alex Comba <alex.comba@agilebg.com>

Lorenzo Battistini <lorenzo.battistini@agilebg.com

-

Giovanni Serra <giovanni@gslab.it>

-

Simone Rubino <sir@takobi.online>

Maintainers

This module is maintained by the OCA.

OCA, or the Odoo Community Association, is a nonprofit organization whose mission is to support the collaborative development of Odoo features and promote its widespread use.

This module is part of the OCA/l10n-italy project on GitHub.

You are welcome to contribute. To learn how please visit https://odoo-community.org/page/Contribute.

Project details

Release history Release notifications | RSS feed

Download files

Download the file for your platform. If you're not sure which to choose, learn more about installing packages.

Source Distributions

Built Distribution

File details

Details for the file odoo_addon_l10n_it_reverse_charge-16.0.1.0.4-py3-none-any.whl.

File metadata

- Download URL: odoo_addon_l10n_it_reverse_charge-16.0.1.0.4-py3-none-any.whl

- Upload date:

- Size: 533.0 kB

- Tags: Python 3

- Uploaded using Trusted Publishing? No

- Uploaded via: twine/5.1.1 CPython/3.12.3

File hashes

| Algorithm | Hash digest | |

|---|---|---|

| SHA256 | 2fd63fe6068f9fa0f19b79e83292a5b0f1e2cef0f5740140f432f6738d49e759 |

|

| MD5 | bd9d08407c5ce9ee407a1d7d99152e50 |

|

| BLAKE2b-256 | 5710ba45d358064e5327a366611edf4c0ae49060091b6fc14f5d4f89296e7518 |