Tool to help find an optimal portfolio allocation

Project description

Porfolio Finder

A Python library, based primarily around pandas, to identify an optimal portfolio allocation through back-testing.

API Documentation is available on Read the Docs.

Example Usage

Each of these examples make use of data.csv which provides returns for a handful of funds over 1970-2019.

Find best portfolio allocation to minimize the required timeframe to achieve a target value

import portfoliofinder as pf

contributions = pf.RegularContributions(100000, 10000)

print(pf.Allocations(0.05, ['USA_TSM', 'WLDx_TSM', 'USA_INT', 'EM'])\

.filter('USA_TSM>=0.6 & WLDx_TSM<=0.2 & USA_INT>=0.3')\

.with_returns(csv="data.csv")\

.with_regular_contributions(100000, 10000)\

.get_backtested_values(timeframe=10)\

.get_statistics(['min', 'max', 'mean', 'std'])\

.filter_by_min_of('max')\

.filter_by_max_of('min')\

.get_allocation_which_min_statistic('std'))

Output

Statistic

min 14.000000

max 22.000000

mean 16.965517

std 2.809204

Name: Allocation(USA_TSM=0.65, WLDx_TSM=0.0, USA_INT=0.3, EM=0.05), dtype: float64

Find best portfolio allocation to maximize value with minimal risk over a fixed timeframe

import portfoliofinder as pf

print(pf.Allocations(0.05, ['USA_TSM', 'WLDx_TSM', 'USA_INT', 'EM'])\

.filter('USA_TSM>=0.6 & WLDx_TSM<=0.2 & USA_INT>=0.3')\

.with_returns(csv="data.csv")\

.with_regular_contributions(100000, 10000)\

.get_backtested_values(timeframe=10)\

.get_statistics(['mean', 'std'])\

.filter_by_gte_percentile_of(90, 'mean')\

.get_allocation_which_min_statistic('std'))

Output

Statistic

mean 446560.590088

std 117448.007302

Name: Allocation(USA_TSM=0.6, WLDx_TSM=0.0, USA_INT=0.3, EM=0.1), dtype: float64

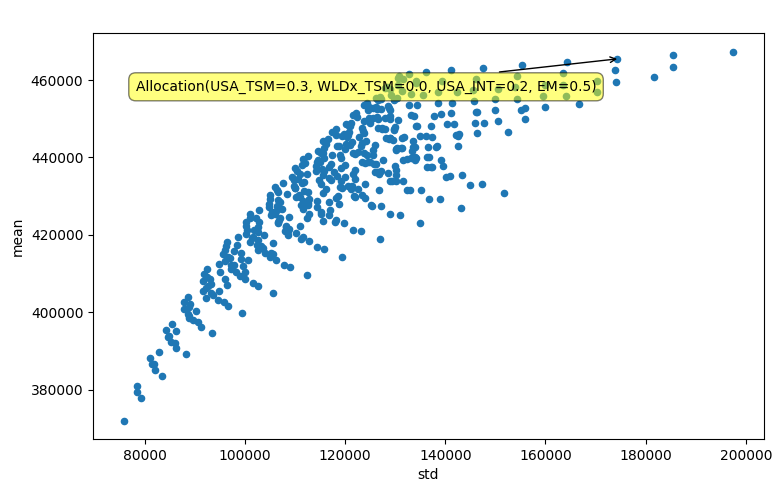

Graph statistics from multiple portfolio allocations to visualize their efficient frontier

import portfoliofinder as pf

allocations = pf.Allocations(0.05, ['USA_TSM', 'WLDx_TSM', 'USA_INT', 'EM'])\

.filter('USA_TSM>=0.2 & USA_INT>=0.2')\

.with_returns(csv="data.csv")\

.with_regular_contributions(100000, 10000)\

.get_backtested_values(timeframe=10)\

.get_statistics()\

.graph('std', 'mean')

Output

Project details

Download files

Download the file for your platform. If you're not sure which to choose, learn more about installing packages.

Source Distribution

portfoliofinder-0.1.tar.gz

(2.7 kB

view hashes)

Built Distributions

Close

Hashes for portfoliofinder-0.1.0-py3-none-any.whl

| Algorithm | Hash digest | |

|---|---|---|

| SHA256 | 2d82bc2ee7faccbe8ed3862c706602774d7d450670088634b52a743e560bc30c |

|

| MD5 | 586edbd4a91e2b25ec4cfdbaec6b1239 |

|

| BLAKE2b-256 | adac23b50f4cb6eb2b3ca4a15ff3999671e25607e7c8357999e874128a68eec8 |

Close

Hashes for portfoliofinder-0.1-py3-none-any.whl

| Algorithm | Hash digest | |

|---|---|---|

| SHA256 | ade60d1d0358f75bf9587ba68146c3d0be1493545bd34f3f273e501c5a7dfe1f |

|

| MD5 | 914137e48cc461ba893f1858edf4532d |

|

| BLAKE2b-256 | 4a98573c190d1b4be6be5462b35b63674b9b8c26b8ec173ea8224d8e81dede12 |