DeGiro Analytics and API tools

Project description

Intro

This is a DeGiro analytics platform. DeGiro is a low-fee Dutch investment broker that, sadly, offers limited account analytics functionality. This project leverages DeGiro's private API and provides some investment performance analytics tools.

Requirments

pandas>=1.4.2

requests>=2.27.1

Installation

pip install degiro_analytics

Docker

If you prefer to run the project in Docker, I made an image available in Docker hub. It contains a Jupyter Notebook with getting-started example.

docker pull degiro-analytics-notebook

docker run -p 8888:8888 degiro-analytics-notebook

Just copy the link with an automatically generated token and plug it to your browser to run Jupyter.

Hint: Make sure you don't have any existing notebooks running on port 8888.

Description

degiro_analytics/DegiroWrapper.py contains API to retrieve current portfolio information and product search. It does not include trading API. There are open-source projects implementing trading API.

degiro_analytics/utils.py contains various methods for portfolio analytics.

Examples.ipynb Refer to this Jupyter Notebook for examples.

Examples

import pandas as pd

from degiro_analytics import DeGiroWrapper

from degiro_analytics.utils import irr, analytics

DGW = DeGiroWrapper(True, True, base_curr='EUR') # you will have to provide your credentials (and possibly multi-factor auth code)

Insights into your portfolio

pf = DGW.get_current_portfolio() # retrieves your current portfolio

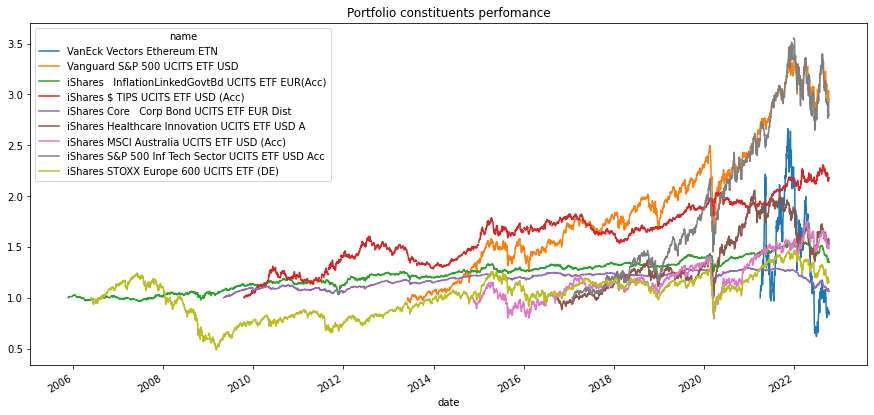

Get price history of your portfolio constituents

P = DGW.get_prices(pf.index)

P = P.pivot(index='date', columns='name', values='price')

P = P.apply(lambda x: x/x.dropna().iloc[0]) # normalize by starting price

P.plot(title='Portfolio constituents perfomance', figsize=(15, 7))

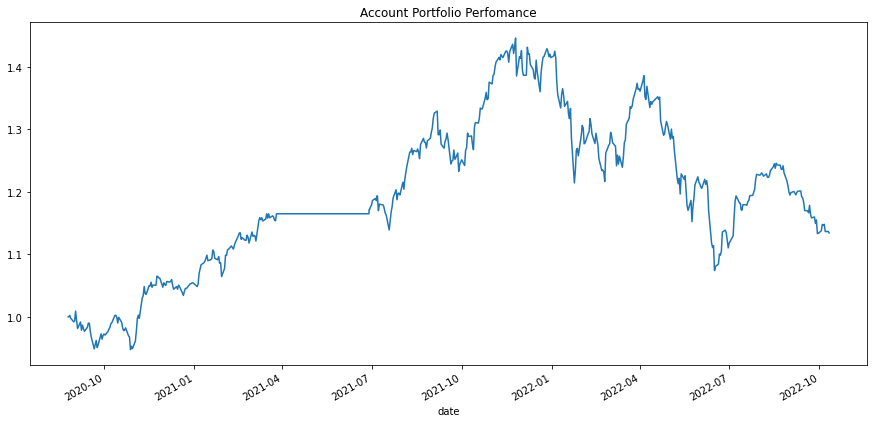

Perfomance of your account

start_date = '01/01/2020' # use any date

T = DGW.get_transactions(start_date) # trasactions history

P = DGW.get_prices(T.productId.unique()) # get price history of all products from T

P = P[P.date>=T.date.min()]

P = pd.pivot_table(P, index='date', columns='productId', values='price', aggfunc='mean') # product per columns

P.fillna(method='ffill', inplace=True)

Q = pd.pivot_table(T, index='date', columns='productId', values='quantity', aggfunc='sum') # number of shares purchased, product per column

Q = Q.reindex(P.index.append(Q.index)).sort_index().fillna(0).cumsum() # portfolio quantities per day

idx = P.index.get_indexer(Q.index, method='nearest')

matched_P = P.iloc[idx].values

The following cell computes portfolio returns as $R_t = \frac{Q_{t-1}'P_t}{Q_{t-1}'P_{t-1}}$.

numerator = Q.shift().multiply(matched_P).sum(axis=1)

denominator = Q.multiply(matched_P).sum(axis=1).shift()

R = numerator/denominator

IDX = R.fillna(1).cumprod() # index (or normalized price) of the portfolio

IDX.plot(title='Account Portfolio Perfomance', figsize=(15, 7))

Some analytics

analytics(IDX)

{'Mean return': 0.00027660251717962994,

'Std': 0.010483131903391498,

'Risk Adjusted Return': 0.02638548477007559,

'Number of drawdowns': 28,

'Maximum Drawdown': 0.25730401117784857,

'Max drawdown duration (days)': 320,

'Mean drawdown duration (days)': 26.035714285714285,

'T': 570}

Cash Flows analysis and money weighted return (IRR)

cf_df = DGW.get_account_cash_flows('01/01/2000', fees=True, dividends=True)

cf = cf_df.set_index('date').CF

cf.loc[pd.to_datetime(DGW.today, dayfirst=True, utc=True)] = pf.Q.multiply(pf.price_base_curr).sum() # current portfolio value

mwr = irr(cf)

print('Money weighted return is', mwr)

Money weighted return is 0.008600000000000003

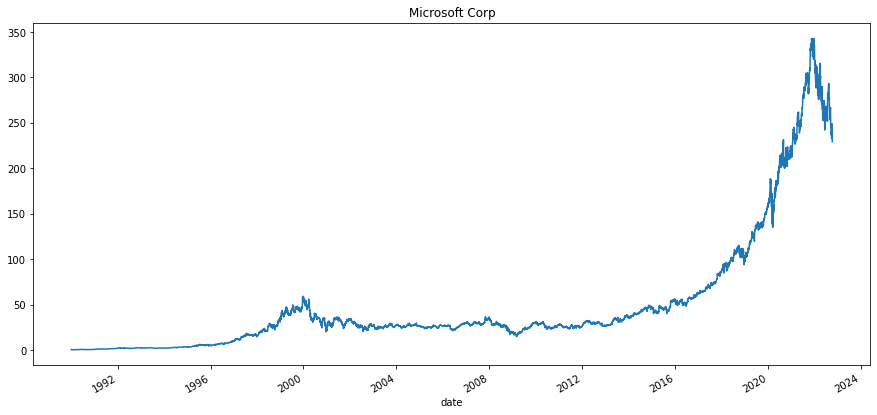

Search products

search_text = 'Microsoft'

product = DGW.lookup(search_text, limit=1)[0]

print('The current price of', product.name, 'is', product.closePrice, product.currency)

p = product.get_price_hist(convert=False).set_index('date').price

p.plot(title=product.name, figsize=(15,7))

The current price of Microsoft Corp is 229.25 USD

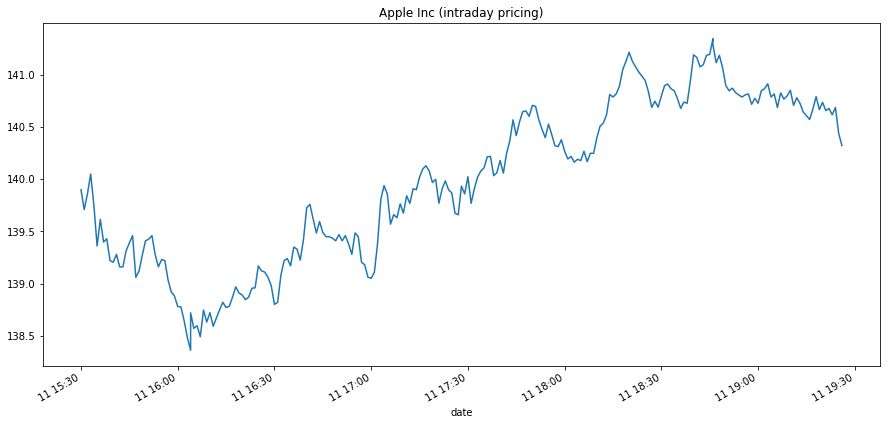

search_text = 'Apple'

product = DGW.lookup(search_text, limit=1)[0]

print('The current price of', product.name, 'is', product.closePrice, product.currency)

p = product.get_price_hist(history='1D', resolution='T1M', convert=False).set_index('date').price

p.plot(title=product.name + ' (intraday pricing)', figsize=(15,7))

The current price of Apple Inc is 140.42 USD

Search and analyze ETFs from core selection

etfs = DGW.search_etfs(only_free=True, limit=200) # returns all ETFs from DeGiro core selection

Loop through the ETFs and analyze the prices

out = []

for etf in etfs:

p = etf.get_price_hist(resolution='1M')

a = analytics(p.set_index('date').price)

a['name'] = etf.name

out.append(a)

pd.DataFrame(out).sort_values('Risk Adjusted Return')

.dataframe tbody tr th {

vertical-align: top;

}

.dataframe thead th {

text-align: right;

}

| Mean return | Std | Risk Adjusted Return | Number of drawdowns | Maximum Drawdown | Max drawdown duration (days) | Mean drawdown duration (days) | T | name | |

|---|---|---|---|---|---|---|---|---|---|

| 185 | -0.003599 | 0.024421 | -0.147393 | 6 | 0.315074 | 1278 | 375.333333 | 80 | Xtrackers USD Corporate Bond UCITS ETF 2D HEUR |

| 100 | -0.001715 | 0.012107 | -0.141665 | 5 | 0.163109 | 852 | 329.000000 | 59 | iShares Core Gl Aggregate Bd UCITS ETF EUR Hgd... |

| 190 | -0.012569 | 0.095570 | -0.131513 | 2 | 0.624981 | 699 | 380.000000 | 27 | The Medical Cannabis and Wellness UCITS ETF Acc |

| 178 | -0.012005 | 0.106949 | -0.112248 | 2 | 0.649046 | 699 | 380.000000 | 27 | Rize Medical Cannabis and Life Sciences UCITS ETF |

| 106 | -0.001573 | 0.015111 | -0.104113 | 4 | 0.207632 | 1064 | 578.250000 | 80 | Vanguard EUR Eurozone Government Bd UCITS ETF EUR |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 72 | 0.015837 | 0.052422 | 0.302098 | 14 | 0.243017 | 396 | 139.357143 | 78 | SPDR MSCI World Technology UCITS ETF |

| 63 | 0.012074 | 0.038280 | 0.315414 | 23 | 0.176644 | 518 | 166.782609 | 149 | Amundi S&P 500 UCITS ETF- EUR (C) |

| 14 | 0.015172 | 0.046238 | 0.328118 | 21 | 0.239507 | 365 | 175.523810 | 142 | iShares NASDAQ 100 UCITS ETF USD (Acc) |

| 172 | 0.023167 | 0.070230 | 0.329876 | 3 | 0.271599 | 365 | 284.333333 | 31 | Lyx Msci Future Etf |

| 149 | 0.025988 | 0.065900 | 0.394360 | 3 | 0.238976 | 365 | 294.333333 | 32 | WisdomTree Battery Solutions UCITS ETF USD Acc |

198 rows × 9 columns

Project details

Download files

Download the file for your platform. If you're not sure which to choose, learn more about installing packages.

Source Distribution

Built Distribution

File details

Details for the file degiro_analytics-0.3.2.tar.gz.

File metadata

- Download URL: degiro_analytics-0.3.2.tar.gz

- Upload date:

- Size: 424.5 kB

- Tags: Source

- Uploaded using Trusted Publishing? No

- Uploaded via: python-httpx/0.23.0

File hashes

| Algorithm | Hash digest | |

|---|---|---|

| SHA256 |

2d74dc5c1c0d01962ef8e6ade92b2a88fc025d07075297eb195d7507718a8f06

|

|

| MD5 |

730da0ce18f3c0ab8177b02e56e32e58

|

|

| BLAKE2b-256 |

819857f501f182139e740d1ed9755a073e52421d08fd5d84a9ca8b13df4aec3d

|

File details

Details for the file degiro_analytics-0.3.2-py3-none-any.whl.

File metadata

- Download URL: degiro_analytics-0.3.2-py3-none-any.whl

- Upload date:

- Size: 11.6 kB

- Tags: Python 3

- Uploaded using Trusted Publishing? No

- Uploaded via: python-httpx/0.23.0

File hashes

| Algorithm | Hash digest | |

|---|---|---|

| SHA256 |

862a5b2cc49f2f9d0d409c093e5c92fa69b843f12f2f15a43e8656b93d620e2b

|

|

| MD5 |

a14d7a68d92b0b9b6c67c8a4d3bcc834

|

|

| BLAKE2b-256 |

0576984934c2ad502a4c76a07fce2cda14860d50e3a226c09c5c54f8e28de825

|