A package for obtaining quotation data from various online and offline sources and calculating the values of technical indicators based on these quotations.

Project description

live_trading_indicators

A package for obtaining quotation data from various online and offline sources and calculating the values of technical indicators based on these quotations. Data from online sources is received automatically. It is possible to receive data in real time. The received data is stored in a file cache with the possibility of quick use. Data integrity is carefully monitored.

In addition to receiving data online, Dataframe Pandas can be used as a data source.

The current version allows you to receive exchange data from:

- Binance (spot, futures USD-M, futures COIN-M).

- Many different exchanges via CCXT (CryptoCurrency eXchange Trading Library)

The data can be obtained in numpy ndarray and Dataframe Pandas..

Package data from online sources is stored by default in the .lti folder of the user's home directory. A significant amount of data can be created in this folder, depending on the number of instruments and their timeframes. Only data received from online sources is saved.

Version 0.6.3

what's new

0.6.3

- New indicator - Aroon

0.6.2

- New indicator - ZigZag

0.6.1

- Displaying indicator charts using matplotlib - see.

- Repeated download attempts in case of errors (request_trys setting).

0.5.3

- New timeframe - 1s

- Optimized loading of a large volume of quotes - benchbarks

- Added intermediate saving when loading for a long time

0.5.2

- Fix for python 3.7

0.5.0

- Optimized data loading, reduced the number of requests to the data source on high timeframes.

- Added the ability to use the CCXT library as a data source.

Installing

pip install live_trading_indicators

Feedback

Quick start

All the examples given here can be found in jupyter notebook examples. There are also benchmark results in jupyter notebook.

Getting quotes (online / cache)

import live_trading_indicators as lti

indicators = lti.Indicators('binance')

ohlcv = indicators.OHLCV('ethusdt', '4h', '2022-07-01', '2022-07-01')

print(ohlcv)

Result:

<OHLCV data> symbol: ethusdt, timeframe: 4h

date: 2022-07-01T00:00 - 2022-07-01T20:00 (length: 6)

empty bars: count 0 (0.00 %), max consecutive 0

Values: time, open, high, low, close, volume

Now ohlcv contains quotes in numpy array (ohlcv.time, ohlcv.open, ohlcv.high, ohlcv.low, ohlcv.close, ohlcv.volume).

Export in pandas dataframe

dataframe = ohlcv.pandas()

print(dataframe.head())

Result:

time open high low close volume

0 2022-07-01 00:00:00 1071.02 1117.00 1050.46 1054.52 430646.8720

1 2022-07-01 04:00:00 1054.52 1076.43 1045.41 1066.81 275557.9328

2 2022-07-01 08:00:00 1066.81 1086.44 1033.44 1050.22 252105.5665

3 2022-07-01 12:00:00 1050.21 1074.23 1043.00 1056.86 298465.0695

4 2022-07-01 16:00:00 1056.86 1083.10 1054.82 1067.91 158796.2248

Example of getting indicator data from Bybit quotes via ccxt (online / cache)

import live_trading_indicators as lti

indicators = lti.Indicators('ccxt.bybit')

macd = indicators.MACD('ETHUSDT', '1h', '2022-07-01', '2022-07-30', period_short=15, period_long=26, period_signal=9)

print(macd[40:].pandas().head())

Result:

time macd signal hist

0 2022-07-02 16:00:00 -1.661969 -3.514499 1.852530

1 2022-07-02 17:00:00 -0.983912 -3.125461 2.141548

2 2022-07-02 18:00:00 -0.081701 -2.617233 2.535532

3 2022-07-02 19:00:00 0.464134 -2.064394 2.528529

4 2022-07-02 20:00:00 0.828222 -1.477419 2.305641

Example of getting indicator data from Pandas quotes

import pandas

import live_trading_indicators as lti

dataframe = pandas.read_csv('tests/data/ETHUSDT-1m-2022-08-15.zip', header=None)

dataframe.rename(columns={0: 'time', 1: 'open', 2: 'high', 3: 'low', 4: 'close', 5: 'volume', }, inplace=True)

indicators = lti.Indicators(dataframe)

macd = indicators.MACD(period_short=15, period_long=26, period_signal=9)

print(macd[40:].pandas().head())

Result:

time macd signal hist

0 2022-08-15 00:40:00 3.403958 2.320975 1.082984

1 2022-08-15 00:41:00 3.540428 2.643593 0.896835

2 2022-08-15 00:42:00 3.594786 2.930063 0.664722

3 2022-08-15 00:43:00 3.684476 3.170449 0.514027

4 2022-08-15 00:44:00 3.763257 3.354183 0.409074

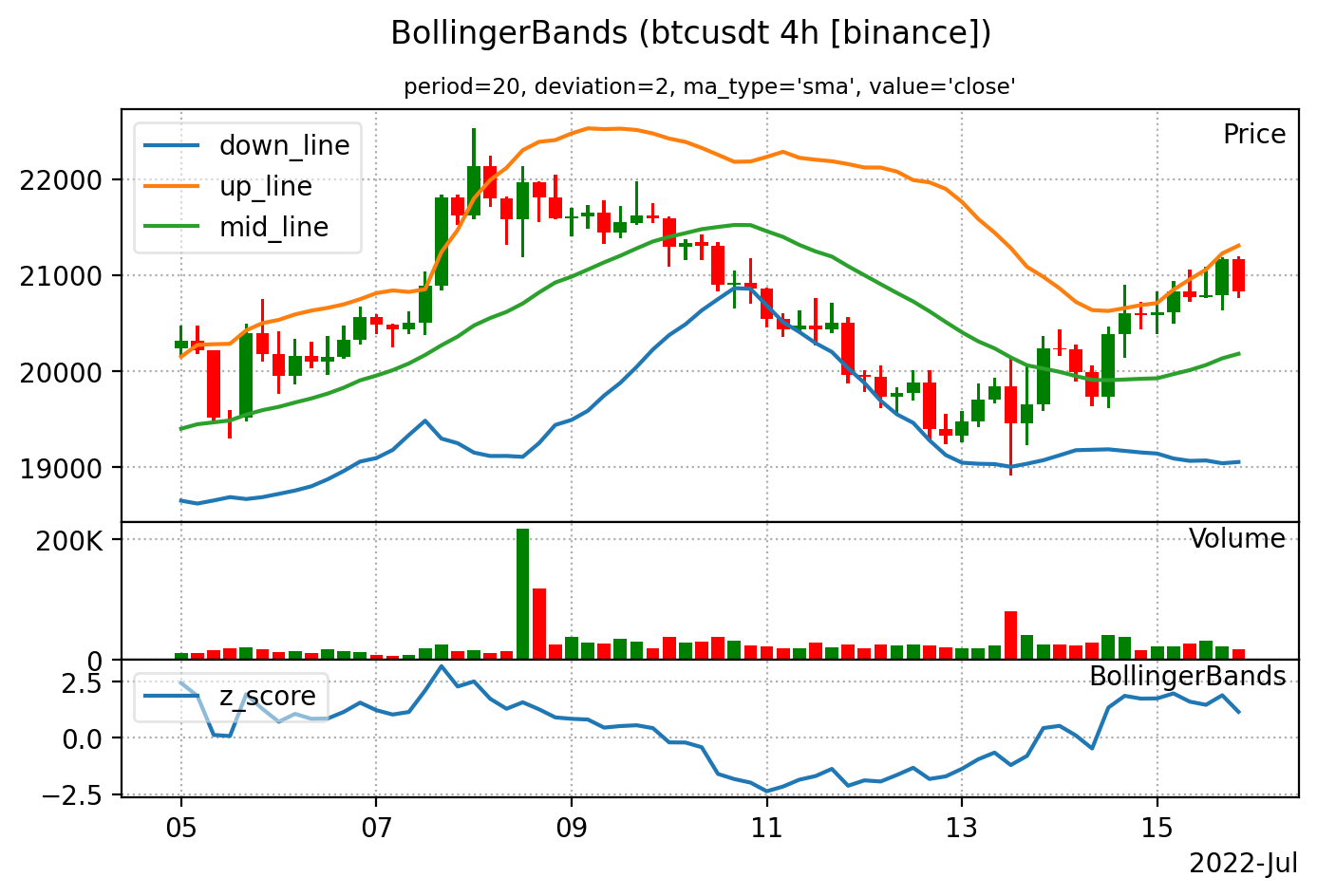

Plotting indicators charts

Plotting uses matplotlib. These are optional features, so matplotlib must be installed separately. There are two methods for plotting: plot() and show(). plot() returns the drawn figure, show() returns None. For jupyter notepad, it is better to use show(), since plot() can draw a figure twice.

indicators = lti.Indicators('binance', '2022-07-01', '2022-07-15')

bb = indicators.BollingerBands('btcusdt', '4h', '2022-07-05', '2022-07-15', period=14)

bb.show()

Result:

Getting real-time data (the last 3 minutes on the 1m timeframe without an incomplete bar)

To get real-time data, you don't have to specify an end date.

import datetime as dt

import live_trading_indicators as lti

utcnow = dt.datetime.utcnow()

print(f'Now is {utcnow} UTC')

indicators = lti.Indicators('binance', utcnow - dt.timedelta(minutes=3))

ohlcv = indicators.OHLCV('btcusdt', '1m')

print(ohlcv.pandas())

Result:

Now is 2022-11-04 09:32:31.528230 UTC

time open high low close volume

0 2022-11-04 09:29:00 20594.39 20595.60 20591.06 20592.38 177.35380

1 2022-11-04 09:30:00 20592.38 20600.98 20591.75 20600.30 178.40869

2 2022-11-04 09:31:00 20600.98 20623.93 20600.30 20621.45 431.11917

Getting real-time data (the last 3 minutes on the 1m timeframe and an incomplete bar)

To get data containing an incomplete bar, you must specify with_incomplete_bar=True when creating Indicators.

utcnow = dt.datetime.utcnow()

print(f'Now is {utcnow} UTC')

indicators = lti.Indicators('binance', utcnow - dt.timedelta(minutes=3), with_incomplete_bar=True)

ohlcv = indicators.OHLCV('btcusdt', '1m')

print(ohlcv.pandas())

Result:

Now is 2022-11-04 09:37:07.372986 UTC

time open high low close volume

0 2022-11-04 09:34:00 20614.55 20618.50 20610.76 20615.97 263.96754

1 2022-11-04 09:35:00 20615.61 20624.00 20610.29 20616.53 258.53777

2 2022-11-04 09:36:00 20615.69 20617.75 20609.74 20611.46 199.43313

3 2022-11-04 09:37:00 20611.11 20611.89 20608.17 20609.02 15.15800

Details

live-trading-indicators supports the following timeframes: 1s, 1m, 3m, 5m, 10m, 15m, 30m, 1h, 2h, 4h, 6h, 8h, 12h, 1d. The specific supported timeframes for the source depend on the source.

Сhecking quotes

live-trading-indicators check the integrity of quotes when they are loaded. The fraction of lost quotes should not exceed max_empty_bars_fraction. The number of lost quotes in a row should not exceed max_empty_bars_consecutive. The values of max_empty_bars_fraction and max_empty_bars_consecutive are set to 0 by default. That is, if there is at least one lost quote, LTIExceptionTooManyEmptyBars will be raised:

live_trading_indicators.exceptions.LTIExceptionTooManyEmptyBars: Too many empty bars: fraction 0.014076769406392695, consecutive 79200. Source binance, symbol ethusdt, timeframe 1s, date 2021-01-01T00:00:00.000 - 2021-12-31T23:59:59.000.

The values of max_empty_bars_fraction and max_empty_bars_consecutive can be set as follows:

import live_trading_indicators as lti

lti.config(max_empty_bars_fraction=0.1, max_empty_bars_consecutive=10)

If you don't need integrity control at all, do:

import live_trading_indicators as lti

lti.config(max_empty_bars_fraction=-1, max_empty_bars_consecutive=-1)

The presence of the first and last bars in the date range is also checked. For more details, see Settings.

Informational messages

By default, log messages are output to the console, and you will see similar messages:

2022-11-04 12:32:31,528 Download using api symbol btcusdt timeframe 1m from 2022-11-04T00:00:00.000...

To disable these messages, run the following code and restart python.

import live_trading_indicators as lti

lti.config(print_log=False)

Indicators

When getting indicator values from online source, the first two parameters should be symbol and timeframe. Further, the period can optionally be specified. Then the parameters of the indicator are specified by name. When getting indicator values offline from Pandas DataFrame parameters symbol and timeframe are not specified.

Example (online)

indicators = lti.Indicators('binance', '2022-07-01', '2022-08-30')

sma = indicators.SMA('ethusdt', '1h', period=9)

macd = indicators.MACD('ethusdt', '1h', '2022-07-01', '2022-07-30', period_short=15, period_long=26, period_signal=9)

Example (offline)

dataframe = pandas.readcsv('ETHUSDT-1m-2022-08-15.zip')

indicators = lti.Indicators(dataframe)

macd = indicators.MACD(period_short=15, period_long=26, period_signal=9)

sma = indicators.SMA('2022-08-15T03:00', '2022-08-15T06:00', period=9)

The list of supported indicators and their parameters can be obtained by calling lti.help(). Parameters symbol, timeframe, time_start, time_end are omitted for brevity.

import live_trading_indicators as lti

print(lti.help())

- ADL(ma_period=None, ma_type='sma') - Accumulation/distribution line.

- ADX(period=14, smooth=14, ma_type='mma') - Average directional movement index.

- ATR(smooth=14, ma_type='mma') - Average true range.

- Aroon(period=14) - Aroon oscillator.

- Awesome(period_fast=5, period_slow=34, ma_type_fast='smw', ma_type_slow='sma', normalized=False) - Awesome oscillator.

- BollingerBands(period=20, deviation=2, ma_type='sma', value='close') - Bollinger bands.

- CCI(period=) - Commodity channel index.

- EMA(period=, value='close') - Exponential moving average.

- Keltner(period=10, multiplier=1, period_atr=10, ma_type='ema', ma_type_atr='mma') - Keltner channel.

- MA(period=, value='close', ma_type='sma') - Moving average of different types: 'sma', 'ema', 'mma', 'ema0', 'mma0'

- MACD(period_short=, period_long=, period_signal=, ma_type='ema', ma_type_signal='sma', value='close') - Moving Average Convergence/Divergence.

- OBV() - On Balance Volume.

- OHLCV() - Quotes: open, high, low, close, volume.

- OHLCVM(timeframe_low='1m', bars_on_bins=6) - Quotes and the price of the maximum volume: open, high, low, close, volume, mv_price.

- ParabolicSAR(start=0.02, maximum=0.2, increment=0.02) - Parabolic SAR.

- ROC(period=14, ma_period=14, ma_type='sma', value='close') - Rate of Change.

- RSI(period=, ma_type='mma', value='close') - Relative strength index.

- SMA(period=, value='close') - Simple moving average.

- Stochastic(period=, period_d=, smooth=3, ma_type='sma') - Stochastic oscillator.

- Supertrend(period=10, multipler=3, ma_type='mma') - Supertrend indicator.

- TEMA(period=, value='close') - Triple exponential moving average.

- TRIX(period=, value='close') - TRIX oscillator.

- VWAP() - Volume-weighted average price.

- VWMA(period=, value='close') - Volume Weighted Moving Average.

- VolumeClusters(timeframe_low='1m', bars_on_bins=6) - OHLCVM and volume clusters is determined by the lower timeframe.

- ZigZag(delta=0.02, type='high_low', redrawable=False) - Zig-zag indicator (pivots).### Specifying the period The period can be specified both during initialization of Indicators and in the indicator parameters. The data type when specifying the period can be datetime.date, datetime.datetime, numpy.datetime64, string, or a number in the format YYYYMMDD.

There are three strategies for specifying a time period:

1. The time period is specified when creating Indicators (base period)

Indicator values can be obtained for any period within the interval specified for Indicators. When exiting the specified interval, an exception will be raised LTIExceptionOutOfThePeriod.

Example

indicators = lti.Indicators('binance', 20220901, 20220930) # the base period

ohlcv = indicators.OHLCV('um/ethusdt', '1h') # the period is not specified, the base period is used

sma22 = indicators.SMA('um/ethusdt', '1h', 20220905, 20220915, period=22) # the period is specified

sma15 = indicators.SMA('um/ethusdt', '1h', 20220905, 20221015, period=15) # ERROR, going beyond the boundaries of the base period

2. The time period is not specified when creating Indicators

In this variant, when getting indicator data, the period should always be specified. When the interval is extended, data may be updated, this may slow down the work.

Example

indicators = lti.Indicators('binance') # period not specified

ohlcv = indicators.OHLCV('um/ethusdt', '1h', 20220801, 20220815) # the period must be specified

ma22 = indicators.SMA('um/ethusdt', '1h', 'close', 22, 20220905, 20220915) # the period must be specified

3. Real-time mode

In this variant, when creating Indicators, only the start date is specified. The data is always received up to the current moment. When creating Indicators, you can specify with_incomplete_bar=True, then the data of the last, incomplete bar will be received. See the example above.

Binance source

Binance trading symbol codes

- For the spot market, they completely coincide with the code on binance (btcusdt, ethusdt, etc.)

- For the futures market USD-M, codes are prefixed with um/ (um/btcusdt, um/ethusdt, etc.)

- For the futures market COIN-M, codes are prefixed with cm/ (cm/btcusd_perp, cm/ethusd_perp, etc.)

CCXT source

Using CCXT, you can download data from a large number of exchanges, currently there are more than 100. The available symbols, their names and timeframes depend on the specific source. More information can be found in the CCXT documentation. The use of ccxt is optional, so it must be installed separately. It can be done like this:

pip install ccxt

Then you can use all available ccxt exchanges by specifying them through a dot. To download, for example, from binance via ccxt, you need to specify ccxt.binance. To download from okx, we use ccxt.okx, Bybit - ccxt.bybit, etc.

Example

indicators = lti.Indicators('ccxt.okx')

ohlcv = indicators.OHLCV('BTC/USDT', '1h', 20220701, 20220702)

live-trading-indicators has not been tested with all quotation sources supported by ccxt. If you find a problem with some data source, open the problem here.

Sometimes the ccxt source may need additional parameters passed through params. In this case, these parameters are passed via exchange_params when creating Indicators:

indicators = lti.Indicators('ccxt.okx', exchange_params={'limit': 300})

Types of move average

live-trading-indicators supports the following types of moving averages:

- 'sma' - simple move average

- 'ema' - classical exponential moving average with alpha = 2 / (n + 1), initialized by SMA (as in binance EMA)

- 'ema0' - classical exponential moving average with alpha = 2 / (n + 1), initialized by the first value

- 'mma' - Modified moving average with alpha = 1 / n, initialized by SMA (as in some binance indicators)

- 'mma0' - Modified moving average с alpha = 1 / n, initialized by the first value

live_trading_indicators library settings

The settings can be obtained as dict using config():

import live_trading_indicators as lti

print(lti.config())

Result:

{'cache_folder': '/home/user/.lti/data/timeframe_data', 'sources_folder': '/home/user/.lti/data/sources', 'log_folder': '/home/hal/.lti/logs', 'endpoints_required': True, 'max_empty_bars_fraction': 0.0, 'max_empty_bars_consecutive': 0, 'restore_empty_bars': True, 'print_log': True, 'log_level': 'INFO', 'request_timeout': 10, 'request_trys': 3}

config() is also used to change the settings:

import live_trading_indicators as lti

lti.config(request_timeout=15)

When creating Indicators, you can specify the settings that will be used instead of the saved ones:

indicators = lti.Indicators(test_source, time_begin, time_end, timeout=15, request_trys=5)

Settings

cache_folder

Directory for storing quotation data.

log_folder

Directory of log files.

endpoints_required

Control of the presence of the first and last bar in the selected date range. In the absence of the first or last bar, LTIExceptionQuotationDataNotFound is raised. Default: True.

max_empty_bars_fraction

The maximum percentage of lost bars, if exceeded, an error will occur.

max_empty_bars_consecutive

The maximum number of lost bars in a row, if exceeded, LTIExceptionTooManyEmptyBars will be raised.

restore_empty_bars

If True, it restores the lost bars (open=close=close of the previous one, volume=0). The control of the number of lost bars (max_empty_bars_fraction, max_empty_bars_consecutive) is performed BEFORE recovery. Default: True.

print_log

If True, outputs log messages to standard output. Default: True.

log_level

Log registration level. Default: INFO.

request_timeout

Timeout of requests to download quotes, seconds. Default: 10.

request_trys

The number of attempts to download quotes. Default: 3.

Project details

Release history Release notifications | RSS feed

Download files

Download the file for your platform. If you're not sure which to choose, learn more about installing packages.

Source Distribution

Built Distribution

File details

Details for the file live_trading_indicators-0.7.0.3.tar.gz.

File metadata

- Download URL: live_trading_indicators-0.7.0.3.tar.gz

- Upload date:

- Size: 40.2 kB

- Tags: Source

- Uploaded using Trusted Publishing? No

- Uploaded via: twine/4.0.1 CPython/3.10.6

File hashes

| Algorithm | Hash digest | |

|---|---|---|

| SHA256 | b4534bd52f786596d267b432ae3ed7a49d8f9eaeeef8af3391dcbe3ca018523f |

|

| MD5 | cec6ee0abc5b7b45697bb653565bae14 |

|

| BLAKE2b-256 | dd349d614acae2b88f12578e621ac60ce6b92355fae4a32ec83581d180a1a69d |

File details

Details for the file live_trading_indicators-0.7.0.3-py3-none-any.whl.

File metadata

- Download URL: live_trading_indicators-0.7.0.3-py3-none-any.whl

- Upload date:

- Size: 57.3 kB

- Tags: Python 3

- Uploaded using Trusted Publishing? No

- Uploaded via: twine/4.0.1 CPython/3.10.6

File hashes

| Algorithm | Hash digest | |

|---|---|---|

| SHA256 | cfbfa2be7aa3929be25dc8db22b1b2d55b1792c46d7eb04898d81d699ab87730 |

|

| MD5 | c6bee7b961288a2c6aa6a277c7c76a7d |

|

| BLAKE2b-256 | 63cfb69e0487338f4bf1582583aaec1bfe4d8cd2c968b064c5b19148a8fb78f7 |