portfolio-backtest is a python library for backtest portfolio asset allocation on Python 3.7 and above.

Project description

portfolio-backtest

portfolio-backtest is a python library for backtest portfolio asset allocation on Python 3.7 and above.

Installation

$ pip install portfolio-backtest

$ pip install PyPortfolioOpt

Usage

basic run

from portfolio_backtest import Backtest

Backtest(tickers=["VTI", "AGG", "GLD"]).run()

advanced run

from portfolio_backtest import Backtest

import pprint

bt = Backtest(

tickers={

"VTI": 0.6,

"AGG": 0.25,

"GLD": 0.15,

},

target_return=0.1,

target_cvar=0.025,

data_dir="data",

start="2011-04-10",

end="2021-04-10",

)

pprint.pprint(bt.run(plot=True))

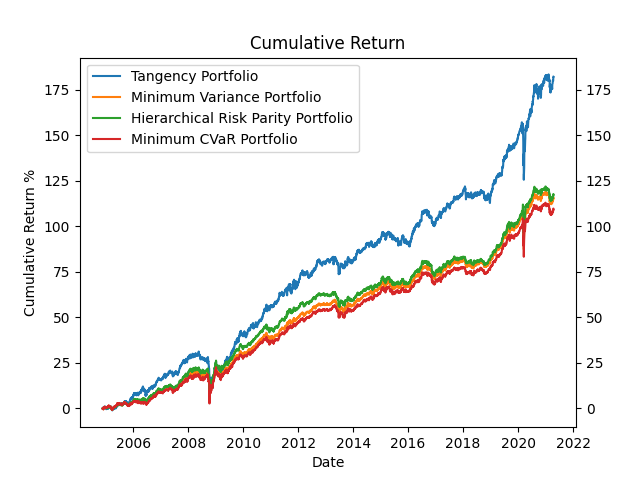

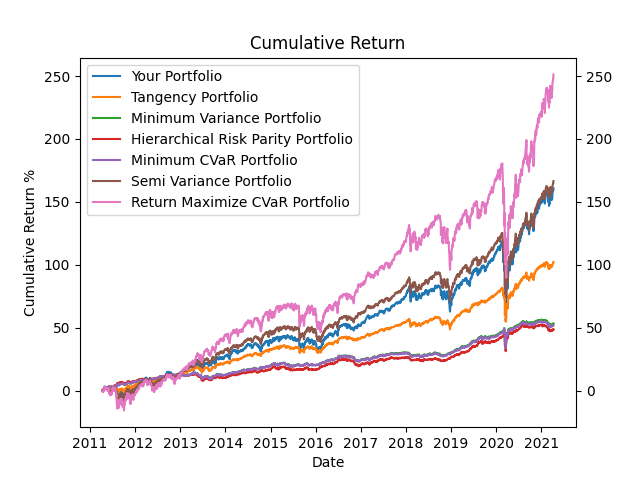

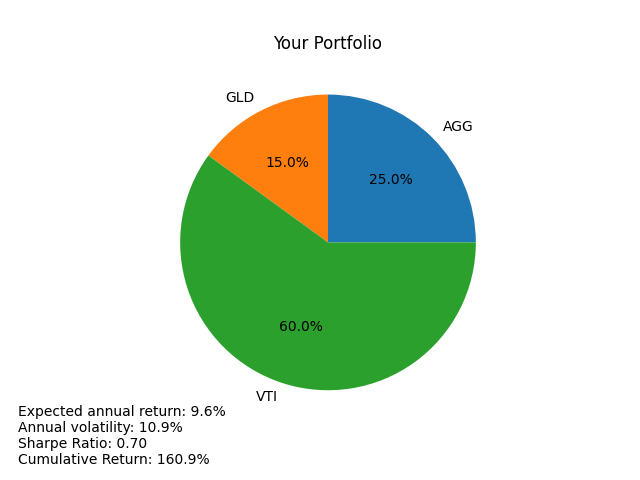

[{'Annual volatility': '10.9%',

'Conditional Value at Risk': '',

'Cumulative Return': '160.9%',

'Expected annual return': '9.6%',

'Sharpe Ratio': '0.70',

'portfolio': 'Your Portfolio',

'tickers': {'AGG': 0.25, 'GLD': 0.15, 'VTI': 0.6}},

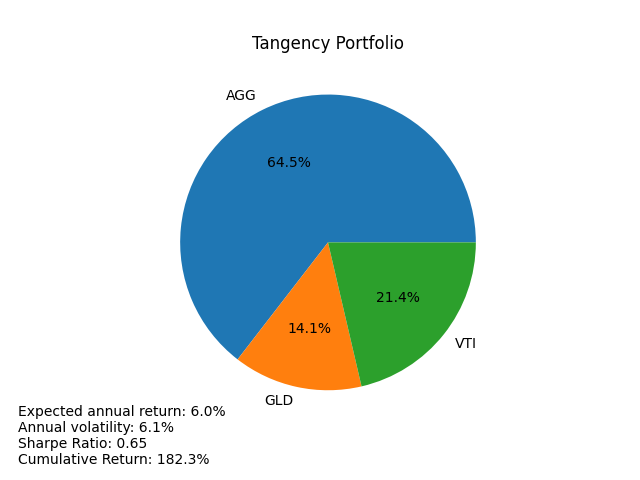

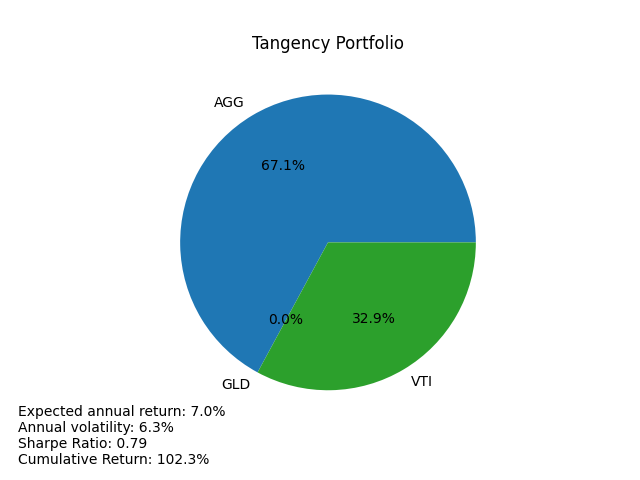

{'Annual volatility': '6.3%',

'Conditional Value at Risk': '',

'Cumulative Return': '102.3%',

'Expected annual return': '7.0%',

'Sharpe Ratio': '0.79',

'portfolio': 'Tangency Portfolio',

'tickers': {'AGG': 0.67099, 'GLD': 0.0, 'VTI': 0.32901}},

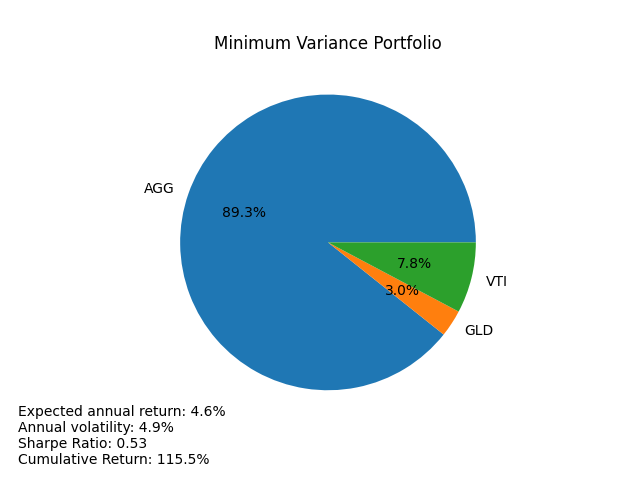

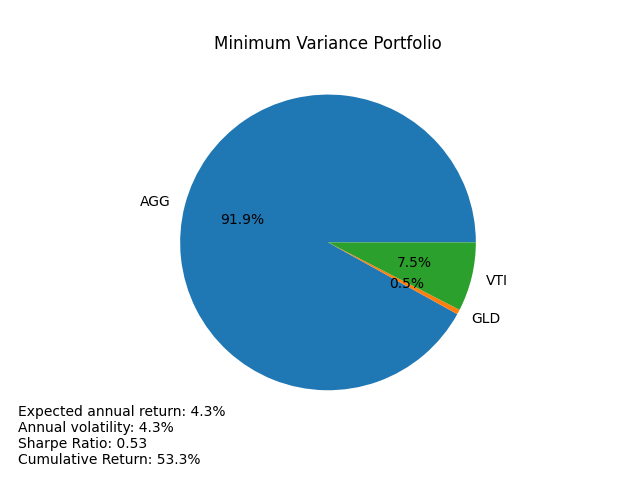

{'Annual volatility': '4.3%',

'Conditional Value at Risk': '',

'Cumulative Return': '53.3%',

'Expected annual return': '4.3%',

'Sharpe Ratio': '0.53',

'portfolio': 'Minimum Variance Portfolio',

'tickers': {'AGG': 0.91939, 'GLD': 0.00525, 'VTI': 0.07536}},

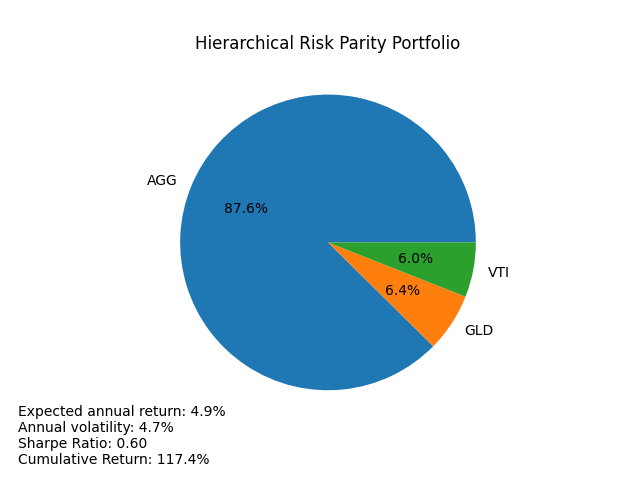

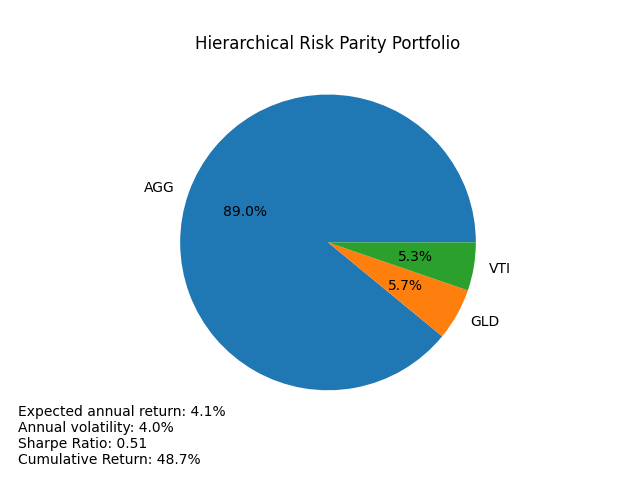

{'Annual volatility': '4.0%',

'Conditional Value at Risk': '',

'Cumulative Return': '48.7%',

'Expected annual return': '4.1%',

'Sharpe Ratio': '0.51',

'portfolio': 'Hierarchical Risk Parity Portfolio',

'tickers': {'AGG': 0.89041, 'GLD': 0.05695, 'VTI': 0.05263}},

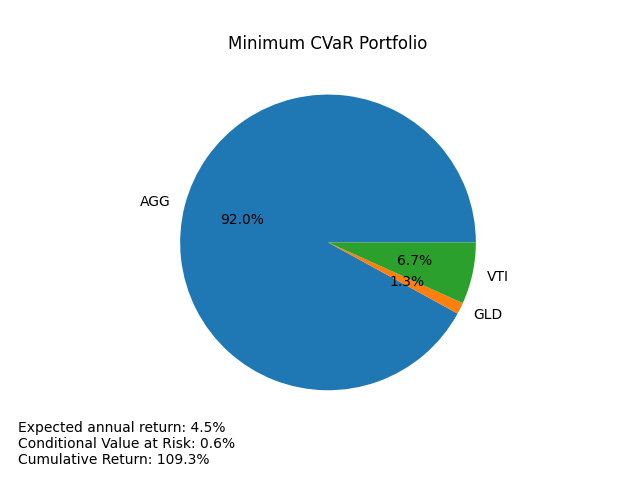

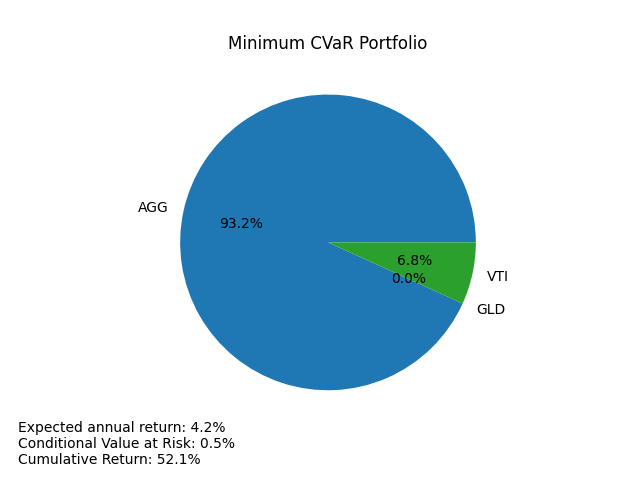

{'Annual volatility': '',

'Conditional Value at Risk': '0.5%',

'Cumulative Return': '52.1%',

'Expected annual return': '4.2%',

'Sharpe Ratio': '',

'portfolio': 'Minimum CVaR Portfolio',

'tickers': {'AGG': 0.93215, 'GLD': 0.0, 'VTI': 0.06785}},

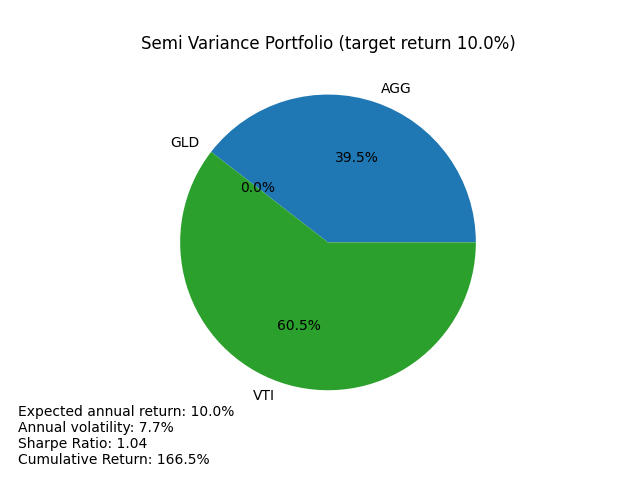

{'Annual volatility': '7.7%',

'Conditional Value at Risk': '',

'Cumulative Return': '166.5%',

'Expected annual return': '10.0%',

'Sharpe Ratio': '1.04',

'portfolio': 'Semi Variance Portfolio (target return 10.0%)',

'tickers': {'AGG': 0.39504, 'GLD': 0.0, 'VTI': 0.60496}},

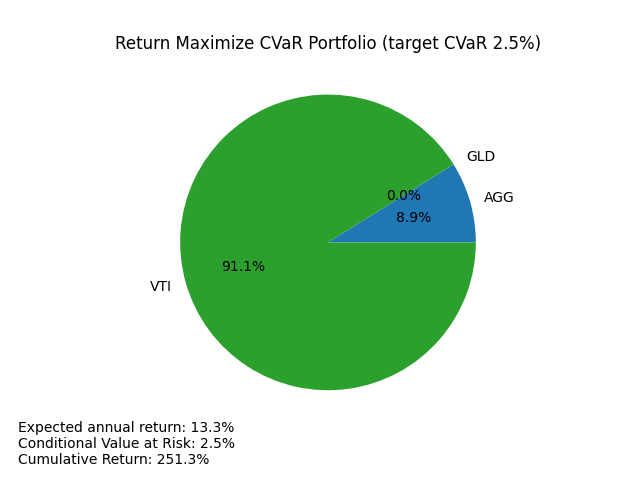

{'Annual volatility': '',

'Conditional Value at Risk': '2.5%',

'Cumulative Return': '251.3%',

'Expected annual return': '13.3%',

'Sharpe Ratio': '',

'portfolio': 'Return Maximize CVaR Portfolio (target CVaR 2.5%)',

'tickers': {'AGG': 0.08851, 'GLD': 0.0, 'VTI': 0.91149}}]

Provides a method (discrete_allocation) that can be converted into an actual allocation available for purchase by entering the latest price and desired portfolio size ($ 10,000 in this example)

from portfolio_backtest import Backtest

bt = Backtest(

tickers={

"VTI": 0.6,

"AGG": 0.25,

"GLD": 0.15,

}

)

print(bt.discrete_allocation(total_portfolio_value=10000))

{'Discrete allocation': {'VTI': 28, 'AGG': 21, 'GLD': 9}, 'Funds remaining': '$109.45'}

Supported Portfolio

- Your Portfolio

- Hierarchical Risk Parity Portfolio

- Tangency Portfolio

- Minimum Variance Portfolio

- Minimum CVaR Portfolio

- Semi Variance Portfolio

- Return Maximize CVaR Portfolio

Project details

Release history Release notifications | RSS feed

Download files

Download the file for your platform. If you're not sure which to choose, learn more about installing packages.

Source Distribution

Built Distribution

Filter files by name, interpreter, ABI, and platform.

If you're not sure about the file name format, learn more about wheel file names.

Copy a direct link to the current filters

File details

Details for the file portfolio-backtest-0.3.0.tar.gz.

File metadata

- Download URL: portfolio-backtest-0.3.0.tar.gz

- Upload date:

- Size: 6.8 kB

- Tags: Source

- Uploaded using Trusted Publishing? No

- Uploaded via: twine/3.4.1 importlib_metadata/3.10.1 pkginfo/1.7.0 requests/2.25.1 requests-toolbelt/0.9.1 tqdm/4.60.0 CPython/3.8.2

File hashes

| Algorithm | Hash digest | |

|---|---|---|

| SHA256 |

fa68ea5afdae5ee1db0167b31733e21608978d25c8142412001433003f78a57a

|

|

| MD5 |

1d9e71084e50c62644fa7e919966ae2e

|

|

| BLAKE2b-256 |

9562b7d21af2f05bd5a31d4702c497d485950c9edd62f13fa0a98169d9e6e1ab

|

File details

Details for the file portfolio_backtest-0.3.0-py3-none-any.whl.

File metadata

- Download URL: portfolio_backtest-0.3.0-py3-none-any.whl

- Upload date:

- Size: 5.8 kB

- Tags: Python 3

- Uploaded using Trusted Publishing? No

- Uploaded via: twine/3.4.1 importlib_metadata/3.10.1 pkginfo/1.7.0 requests/2.25.1 requests-toolbelt/0.9.1 tqdm/4.60.0 CPython/3.8.2

File hashes

| Algorithm | Hash digest | |

|---|---|---|

| SHA256 |

f326fc7364d0aba475a481f417e9d68692d1c0ea80bb2c2963bc8a3fbe17a301

|

|

| MD5 |

138c64f89c1ae27e285b129383732eba

|

|

| BLAKE2b-256 |

a5e28ba876c7438572647808434a290c6eda48acebe39428689da257d28633ca

|