Backtest trading strategies or train reinforcement learning agents with and event-driven market simulator.

Project description

Introduction

Backtest trading strategies or train reinforcement learning agents with

tradingenv, an event-driven market simulator that implements the

OpenAI/gym protocol.

Installation

tradingenv supports Python 3.9 or newer versions. The following command line will install the latest software version.

pip install tradingenv

Notebooks, software tests and building the documentation require extra dependencies that can be installed with

pip install tradingenv[extra]

Examples

Reinforcement Learning

The package is built upon the industry-standard gym and therefore can be used in conjunction with popular reinforcement learning frameworks including rllib, stable-baselines3 and ElegantRL.

from tradingenv.env import TradingEnvXY

import yfinance

# Load data from Yahoo Finance.

tickers = yfinance.Tickers(['SPY', 'TLT', 'TBIL', '^IRX'])

data = tickers.history(period="12mo", progress=False)['Close'].tz_localize(None)

Y = data[['SPY', 'TLT']]

X = Y.rolling(12).mean() - Y.rolling(26).mean()

# Instance the trading environment.

env = TradingEnvXY(

X=X, # Use moving averages crossover as features

Y=Y, # to trade SPY and TLT ETFs.

transformer='z-score', # Features are standardised to N(0, 1).

reward='logret', # Reward is the log return of the portfolio at each step,

cash=1000000, # starting with $1M.

spread=0.0002, # Transaction costs include a 0.02% spread,

markup=0.005, # a 0.5% broker markup on deposit rate,

fee=0.0002, # a 0.02% dealing fee of traded notional

fixed=1, # and a $1 fixed fee per trade.

margin=0.02, # Do not trade if trade size is smaller than 2% of the portfolio.

rate=data['^IRX'] / 100, # Rate used to compute the yield on idle cash and cost of leverage.

latency=0, # Trades are implemented with no latency

steps_delay=1, # but a delay of one day.

window=1, # The observation is the current state of the market,

clip=5., # clipped between -5 and +5 standard deviations.

max_long=1.5, # The maximum long position is 150% of the portfolio,

max_short=-1., # the maximum short position is 100% of the portfolio.

calendar='NYSE', # Use the NYSE calendar to schedule trading days.

)

# OpenAI/gym protocol. Run an episode in the environment.

obs = env.reset()

done = False

while not done:

action = env.action_space.sample()

obs, reward, done, info = env.step(action)

Backtesting

Thanks to the event-driven design, tradingenv is agnostic with respect to the type and time-frequency of the events. This means that you can run simulations either using irregularly sampled trade and quotes data, daily closing prices, monthly economic data or alternative data. Financial instruments supported include stocks, ETF and futures.

from tradingenv.policy import AbstractPolicy

class Portfolio6040(AbstractPolicy):

"""Implement logic of your investment strategy or RL agent here."""

def act(self, state):

"""Invest 60% of the portfolio in SPY ETF and 40% in TLT ETF."""

return [0.6, 0.4]

# Run the backtest.

track_record = env.backtest(

policy=Portfolio6040(),

risk_free=data['TBIL'],

benchmark=data['SPY'],

)

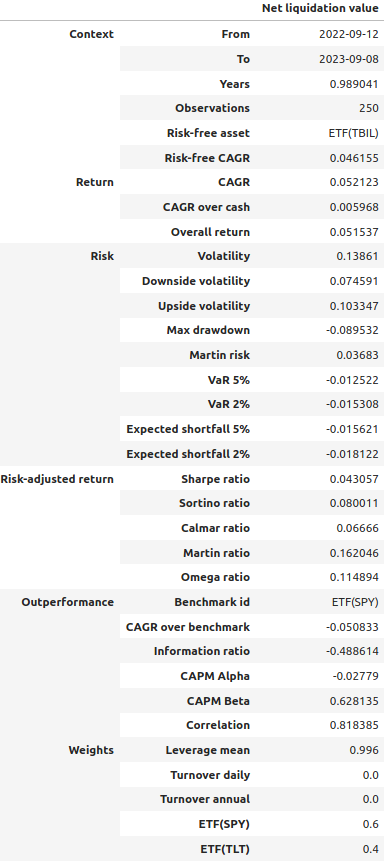

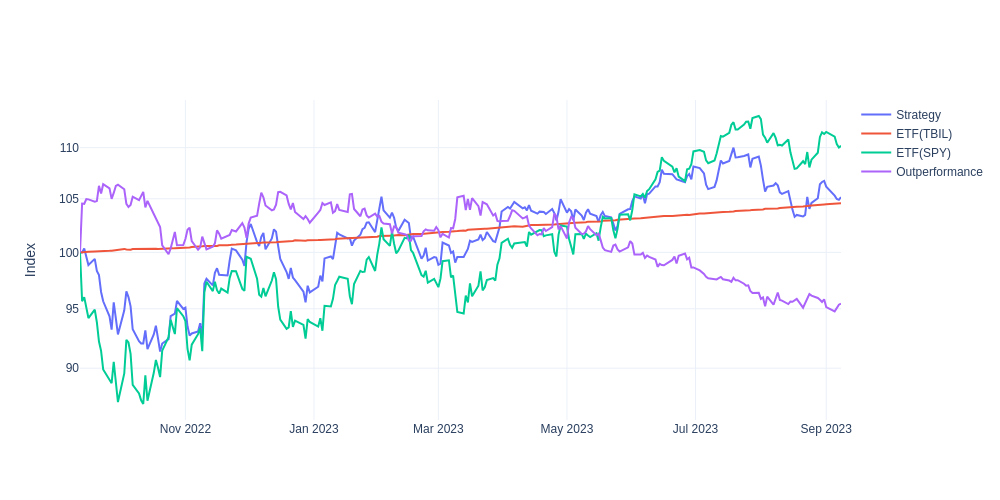

# The track_record object stores the results of your backtest.

track_record.tearsheet()

track_record.fig_net_liquidation_value()

Relevant projects

- btgym: is an OpenAI Gym-compatible environment for

- backtrader backtesting/trading library, designed to provide gym-integrated framework for running reinforcement learning experiments in [close to] real world algorithmic trading environments.

- gym: A toolkit for developing and comparing reinforcement learning algorithms.

- qlib: Qlib provides a strong infrastructure to support quant research.

- rllib: open-source library for reinforcement learning.

- stable-baselines3: is a set of reliable implementations of reinforcement learning algorithms in PyTorch.

Developers

You are welcome to contribute features, examples and documentation or issues.

You can run the software tests typing pytest in the command line,

assuming that the folder \tests is in the current working directory.

To refresh and build the documentation:

pytest tests/notebooks

sphinx-apidoc -f -o docs/source tradingenv

cd docs

make clean

make html

Project details

Download files

Download the file for your platform. If you're not sure which to choose, learn more about installing packages.

Source Distribution

Built Distribution

Filter files by name, interpreter, ABI, and platform.

If you're not sure about the file name format, learn more about wheel file names.

Copy a direct link to the current filters

File details

Details for the file tradingenv-0.1.3.tar.gz.

File metadata

- Download URL: tradingenv-0.1.3.tar.gz

- Upload date:

- Size: 118.7 kB

- Tags: Source

- Uploaded using Trusted Publishing? No

- Uploaded via: twine/6.1.0 CPython/3.12.3

File hashes

| Algorithm | Hash digest | |

|---|---|---|

| SHA256 |

0fe7d42e3631fb56d712bb4812043034f85faf9cbb6012bf7fff85ddba18c2fd

|

|

| MD5 |

c293a373a2595f6558d58037fc511717

|

|

| BLAKE2b-256 |

30c65d01dd621ad37f03c2eb4f76482cfe54725c96297a986cd43c220a46ed4d

|

File details

Details for the file tradingenv-0.1.3-py3-none-any.whl.

File metadata

- Download URL: tradingenv-0.1.3-py3-none-any.whl

- Upload date:

- Size: 133.3 kB

- Tags: Python 3

- Uploaded using Trusted Publishing? No

- Uploaded via: twine/6.1.0 CPython/3.12.3

File hashes

| Algorithm | Hash digest | |

|---|---|---|

| SHA256 |

c8a5d4ede0686039026233b7e8af2570de605f83875a93ee8693580b329f6df8

|

|

| MD5 |

38c468e3b8bfd90223e5e078ee299f95

|

|

| BLAKE2b-256 |

509cee86a53e1f3aca21d2869e398ee5bc39ee4e0c0031c95e2decb0d634cc34

|