A Pythonic backtester for trading algorithms

Project description

Installation

Used packages and environment

- Main package: Zipline-reloaded 2.2.0

- Python 3.8 or above

- Microsoft Windows OS

- Other Python dependency packages: Pandas, Numpy, Logbook, Exchange-calendars

How to install Zipline Reloaded modified by TEJ

-

We're going to illustrate under anaconda environment, so we suggest using Anaconda as development environment.

-

Download dependency packages. (zipline-tej.yml)

-

Start an Anaconda (base) prompt, create an virtual environment and install the appropriate versions of packages: (We strongly recommand using virtual environment to keep every project independent.) (reason)

# change directionary to the folder exists zipline-tej.yml

cd <C:\Users\username\Downloads>

# create virtual env

$ conda env create -f zipline-tej.yml

# activate virtual env

$ conda activate zipline-tej

Also, if you are familiar with Python enough, you can create a virtual environment without zipline-tej.yml and here's the sample :

# create virtual env

$ conda create -n <env_name> python=3.8

# activate virtual env

$ conda activate <env_name>

# download dependency packages

$ conda install -c conda-forge -y ta-lib

$ pip install zipline-tej

- Notice that we need to download TA-lib at first, so that we can download zipline-tej successfully.

Exchange Calendar Issues

We're now developing specfic on Taiwan securities backtesting strategy, so we're using the unique trading calendar created by ourselves. download

After downloaded the calendar file above, overwrite calendar_utils.py in exchange_calendars folder and add exchange_calendar_tejxtai.py.

* Navigate to the exchange_calendars folder within site packages. This is typically located at C:\Users\username\Anaconda3\envs\zipline-tej\Lib\site-packages\exchange_calendars

But some users may located at C:\Users\username\AppData\Roaming\Python\Python38\Scripts which we aren't pleased to see. So if this happened, we suggest to put exchange-calendars folder to former path we mentioned above.

Quick start

CLI Interface

The following code implements a simple buy_and_hold trading algorithm.

from zipline.api import order, record, symbol

def initialize(context):

context.asset = symbol("2330")

def handle_data(context, data):

order(context.asset, 10)

record(TSMC=data.current(context.asset, "price"))

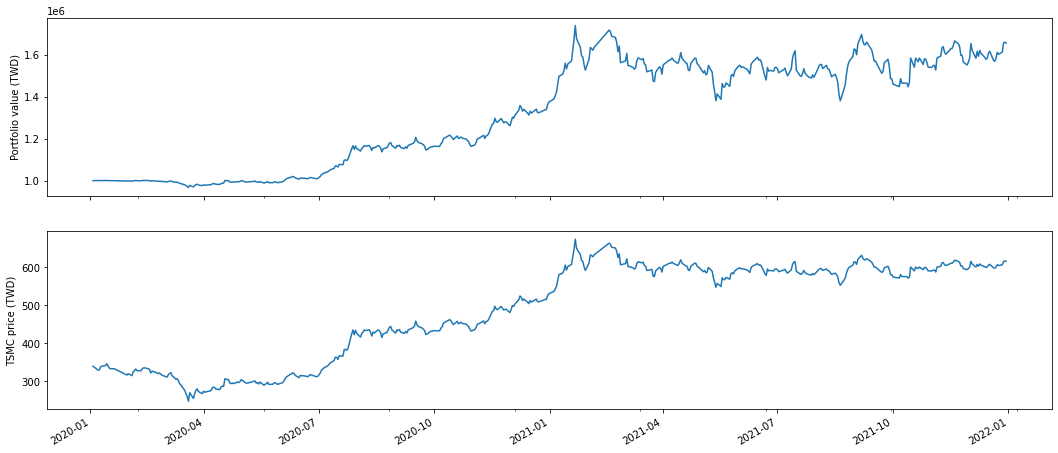

def analyze(context=None, results=None):

import matplotlib.pyplot as plt

# Plot the portfolio and asset data.

ax1 = plt.subplot(211)

results.portfolio_value.plot(ax=ax1)

ax1.set_ylabel("Portfolio value (TWD)")

ax2 = plt.subplot(212, sharex=ax1)

results.TSMC.plot(ax=ax2)

ax2.set_ylabel("TSMC price (TWD)")

# Show the plot.

plt.gcf().set_size_inches(18, 8)

plt.show()

You can then run this algorithm using the Zipline CLI. But first, you need to download some market data with historical prices and trading volumes:

- Before ingesting data, you have to set some environment variables as follow:

# setting TEJAPI_KEY to get permissions loading data

$ set TEJAPI_KEY=<your_key>

# setting download ticker

$ set ticker=2330 2317

# setting backtest period

$ set mdate=20200101 20220101

- Ingest and run backtesting algorithm

$ zipline ingest -b tquant

$ zipline run -f buy_and_hold.py --start 20200101 --end 20220101 -o bah.pickle --no-benchmark --trading-calendar TEJ_XTAI

Then, the resulting performance DataFrame is saved as bah.pickle, which you can load and analyze from Python.

Jupyter Notebook

Set environment variables TEJAPI_KEY, ticker and mdate

* ticker would be your target ticker symbol, and it should be a string. If there're more than one ticker needed, use " ", "," or ";" to split them apart.

* mdate refers the begin date and end date, use " ", "," or ";" to split them apart.

In[1]:

import os

os.environ['TEJAPI_KEY'] = <your_key>

os.environ['ticker'] ='2330 2317'

os.environ['mdate'] ='20200101 20220101'

Call ingest to download data to ~\.zipline

In[2]:

!zipline ingest -b tquant

[Out]:

Merging daily equity files:

[YYYY-MM-DD HH:mm:ss.ssssss] INFO: zipline.data.bundles.core: Ingesting tquant.

Design the backtesting strategy

In[3]:

from zipline.api import order, record, symbol

def initialize(context):

context.asset = symbol("2330")

def handle_data(context, data):

order(context.asset, 10)

record(TSMC=data.current(context.asset, "price"))

def analyze(context=None, results=None):

import matplotlib.pyplot as plt

# Plot the portfolio and asset data.

ax1 = plt.subplot(211)

results.portfolio_value.plot(ax=ax1)

ax1.set_ylabel("Portfolio value (TWD)")

ax2 = plt.subplot(212, sharex=ax1)

results.TSMC.plot(ax=ax2)

ax2.set_ylabel("TSMC price (TWD)")

# Show the plot.

plt.gcf().set_size_inches(18, 8)

plt.show()

Run backtesting algorithm and plot

In[4]:

from zipline import run_algorithm

import pandas as pd

from zipline.utils.calendar_utils import get_calendar

trading_calendar = get_calendar('TEJ_XTAI')

start = pd.Timestamp('20200103', tz ='utc' )

end = pd.Timestamp('20211230', tz='utc')

result = run_algorithm(start=start,

end=end,

initialize=initialize,

capital_base=1000000,

handle_data=handle_data,

bundle='tquant',

trading_calendar=trading_calendar,

analyze=analyze,

data_frequency='daily'

)

[Out]:

Show trading process

In[5]:

result

[Out]:

| period_open | period_close | starting_value | ending_value | starting_cash | ending_cash | portfolio_value | longs_count | shorts_count | long_value | ... | treasury_period_return | trading_days | period_label | algo_volatility | benchmark_period_return | benchmark_volatility | algorithm_period_return | alpha | beta | sharpe | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2020-01-03 05:30:00+00:00 | 2020-01-03 01:01:00+00:00 | 2020-01-03 05:30:00+00:00 | 0.0 | 0.0 | 1.000000e+06 | 1.000000e+06 | 1.000000e+06 | 0 | 0 | 0.0 | ... | 0.0 | 1 | 2020-01 | NaN | 0.0 | NaN | 0.000000 | None | None | NaN |

| 2020-01-06 05:30:00+00:00 | 2020-01-06 01:01:00+00:00 | 2020-01-06 05:30:00+00:00 | 0.0 | 3320.0 | 1.000000e+06 | 9.966783e+05 | 9.999983e+05 | 1 | 0 | 3320.0 | ... | 0.0 | 2 | 2020-01 | 0.000019 | 0.0 | 0.0 | -0.000002 | None | None | -11.224972 |

| 2020-01-07 05:30:00+00:00 | 2020-01-07 01:01:00+00:00 | 2020-01-07 05:30:00+00:00 | 3320.0 | 6590.0 | 9.966783e+05 | 9.933817e+05 | 9.999717e+05 | 1 | 0 | 6590.0 | ... | 0.0 | 3 | 2020-01 | 0.000237 | 0.0 | 0.0 | -0.000028 | None | None | -10.038514 |

| 2020-01-08 05:30:00+00:00 | 2020-01-08 01:01:00+00:00 | 2020-01-08 05:30:00+00:00 | 6590.0 | 9885.0 | 9.933817e+05 | 9.900850e+05 | 9.999700e+05 | 1 | 0 | 9885.0 | ... | 0.0 | 4 | 2020-01 | 0.000203 | 0.0 | 0.0 | -0.000030 | None | None | -9.298128 |

| 2020-01-09 05:30:00+00:00 | 2020-01-09 01:01:00+00:00 | 2020-01-09 05:30:00+00:00 | 9885.0 | 13500.0 | 9.900850e+05 | 9.867083e+05 | 1.000208e+06 | 1 | 0 | 13500.0 | ... | 0.0 | 5 | 2020-01 | 0.001754 | 0.0 | 0.0 | 0.000208 | None | None | 5.986418 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2021-12-24 05:30:00+00:00 | 2021-12-24 01:01:00+00:00 | 2021-12-24 05:30:00+00:00 | 2920920.0 | 2917320.0 | -1.308854e+06 | -1.314897e+06 | 1.602423e+06 | 1 | 0 | 2917320.0 | ... | 0.0 | 484 | 2021-12 | 0.232791 | 0.0 | 0.0 | 0.602423 | None | None | 1.170743 |

| 2021-12-27 05:30:00+00:00 | 2021-12-27 01:01:00+00:00 | 2021-12-27 05:30:00+00:00 | 2917320.0 | 2933040.0 | -1.314897e+06 | -1.320960e+06 | 1.612080e+06 | 1 | 0 | 2933040.0 | ... | 0.0 | 485 | 2021-12 | 0.232577 | 0.0 | 0.0 | 0.612080 | None | None | 1.182864 |

| 2021-12-28 05:30:00+00:00 | 2021-12-28 01:01:00+00:00 | 2021-12-28 05:30:00+00:00 | 2933040.0 | 2982750.0 | -1.320960e+06 | -1.327113e+06 | 1.655637e+06 | 1 | 0 | 2982750.0 | ... | 0.0 | 486 | 2021-12 | 0.233086 | 0.0 | 0.0 | 0.655637 | None | None | 1.237958 |

| 2021-12-29 05:30:00+00:00 | 2021-12-29 01:01:00+00:00 | 2021-12-29 05:30:00+00:00 | 2982750.0 | 2993760.0 | -1.327113e+06 | -1.333276e+06 | 1.660484e+06 | 1 | 0 | 2993760.0 | ... | 0.0 | 487 | 2021-12 | 0.232850 | 0.0 | 0.0 | 0.660484 | None | None | 1.243176 |

| 2021-12-30 05:30:00+00:00 | 2021-12-30 01:01:00+00:00 | 2021-12-30 05:30:00+00:00 | 2993760.0 | 2995050.0 | -1.333276e+06 | -1.339430e+06 | 1.655620e+06 | 1 | 0 | 2995050.0 | ... | 0.0 | 488 | 2021-12 | 0.232629 | 0.0 | 0.0 | 0.655620 | None | None | 1.235305 |

488 rows × 38 columns

Common errors

- NotSessionError : The date of algorithm start date or end date is not available in trading algorithm.

- Solution : Adjust start date or end date to align trading calendar.

- DateOutOfBounds : The trading calendar would update every day, but it would be fixed on the FIRST TIME executed date in Jupyter Notebook.

- Solution : Restart Jupyter Notebook kernel.

More Zipline Tutorials

- For more tutorials

Suggestions

- To get TEJAPI_KEY (link)

- TEJ Official Website

Project details

Release history Release notifications | RSS feed

Download files

Download the file for your platform. If you're not sure which to choose, learn more about installing packages.

Source Distribution

Built Distribution

File details

Details for the file zipline-tej-0.0.30.tar.gz.

File metadata

- Download URL: zipline-tej-0.0.30.tar.gz

- Upload date:

- Size: 11.6 MB

- Tags: Source

- Uploaded using Trusted Publishing? No

- Uploaded via: twine/4.0.2 CPython/3.8.16

File hashes

| Algorithm | Hash digest | |

|---|---|---|

| SHA256 | 10c8976b6747a9c6d19feb129937fc8c0a9daaaa0a80c9efda3d46c72a8df62c |

|

| MD5 | 54a08d178c5ef433fea0d4421aacee43 |

|

| BLAKE2b-256 | 6fe4198482179d7ce29c5b0f78d8095194189d957866bba146cbd5a445a1dcfe |

File details

Details for the file zipline_tej-0.0.30-cp38-cp38-win_amd64.whl.

File metadata

- Download URL: zipline_tej-0.0.30-cp38-cp38-win_amd64.whl

- Upload date:

- Size: 4.1 MB

- Tags: CPython 3.8, Windows x86-64

- Uploaded using Trusted Publishing? No

- Uploaded via: twine/4.0.2 CPython/3.8.16

File hashes

| Algorithm | Hash digest | |

|---|---|---|

| SHA256 | d1ac2937d3efc38187074d684a9ba2d27c92b8e132b293fbd40dcce1f269f324 |

|

| MD5 | eb511fcacbaa7b67714480163e5bb5e1 |

|

| BLAKE2b-256 | aa9f8828ae3f9a79d1b71e520c334ab17a770bc6faf91756d49c2407021af278 |